Why You (Probably) Don’t Need LLCs for Your Rental Properties

Last updated: 2025

When you purchase a rental property, you have an important choice to make right out of the gates: will you own the property in your own name, or form a business entity (LLC) that will own it?

There is much already written on this topic in online forums and blogs. Before I sat down to compose this article, I did a broad survey of that existing writing, and found that nearly all of it falls into two primary categories:

Arguments in favor of LLCs

Ostensibly neutral discussions of the pros and cons, but generally favoring LLCs

I’ve examined all the arguments that others have used in support of the idea that you should own rental properties in LLCs, and I believe many of them overstate the benefits and gloss over the costs. As a result, I’m going to buck the orthodoxy on this topic: I will argue that it is absolutely fine, and in many ways preferable, for the average investor to own their rental properties in their own name. (There is only one clear exception to this, which I’ll get to later in the post.)

Here are the five arguments most frequently used in favor of LLCs for rental properties, each of which I will address in turn:

LLCs limit your liability

LLCs offer tax advantages

LLCs allow you to separate business & personal expenses

LLCs help you remain anonymous

LLCs facilitate splitting ownership with a partner

In addition to examining the strengths and weaknesses of each of these arguments, I’ll also lay out three further reasons to consider NOT using an LLC:

It costs money, every year, forever

It’s complicated

It makes it much harder to get a mortgage

Here’s the requisite disclaimer for this discussion: I am not a lawyer, a tax attorney, or a certified accountant. It may be a good idea to speak to these learned professionals about how you set up your business structures.

Disclaimer for the disclaimer: don’t forget the old adage that “when all you have is a hammer, everything looks like a nail.” It is very likely that any lawyer or tax accountant you speak to will advise you to set up an LLC. Why? Because when you ask a lawyer whether you need a lawyer, or an accountant whether you need an accountant, the answer is nearly always yes. By all means, talk to them – just remember who you’re talking to and what their incentives are.

As a result of this “hammer and nail” dynamic, it can be difficult to find unbiased advice on this topic. I can only share my own experience, and what I’ve learned in my research as I considered whether to hold my own rental properties in an LLC. (For the record, I do hold all 25 of my rental properties in my own name, as do nearly all of my coaching clients.)

One more quick thing…

Want more personalized help with rental property investing decisions like these? You’re not alone — deciding on business structures is one of the decisions I help my private coaching clients make as I help them to acquire their own rental properties. In fact, I’ve helped my clients purchase HUNDREDS of properties over the years that are now generating cash flow and building wealth for them. Schedule a free consultation if you’d like to chat with me about rental property coaching, or learn more about my coaching program & structure.

OK, let’s dive into LLCs! But before I get into each of the specific arguments used in support of LLCs, let’s quickly review what an LLC actually is.

What is an LLC?

An LLC, or limited liability company, is a US-specific legal business structure that has become very popular with small business owners. It combines the pass-through taxation of a sole proprietorship or partnership (whereby the company’s profits are not taxed directly, but rather “pass through” to the individual tax returns of the owner or owners) with the limited liability of a corporation.

The owners of an LLC are called members. It is common for an LLC to have only one owner, in which case it is referred to as a single-member LLC.

By putting a rental property into an LLC, you’re really saying that it’s not YOU who owns and rents real estate – instead, you own a COMPANY that owns and rents real estate. This is an important distinction for both liability and taxation, as we’ll see shortly.

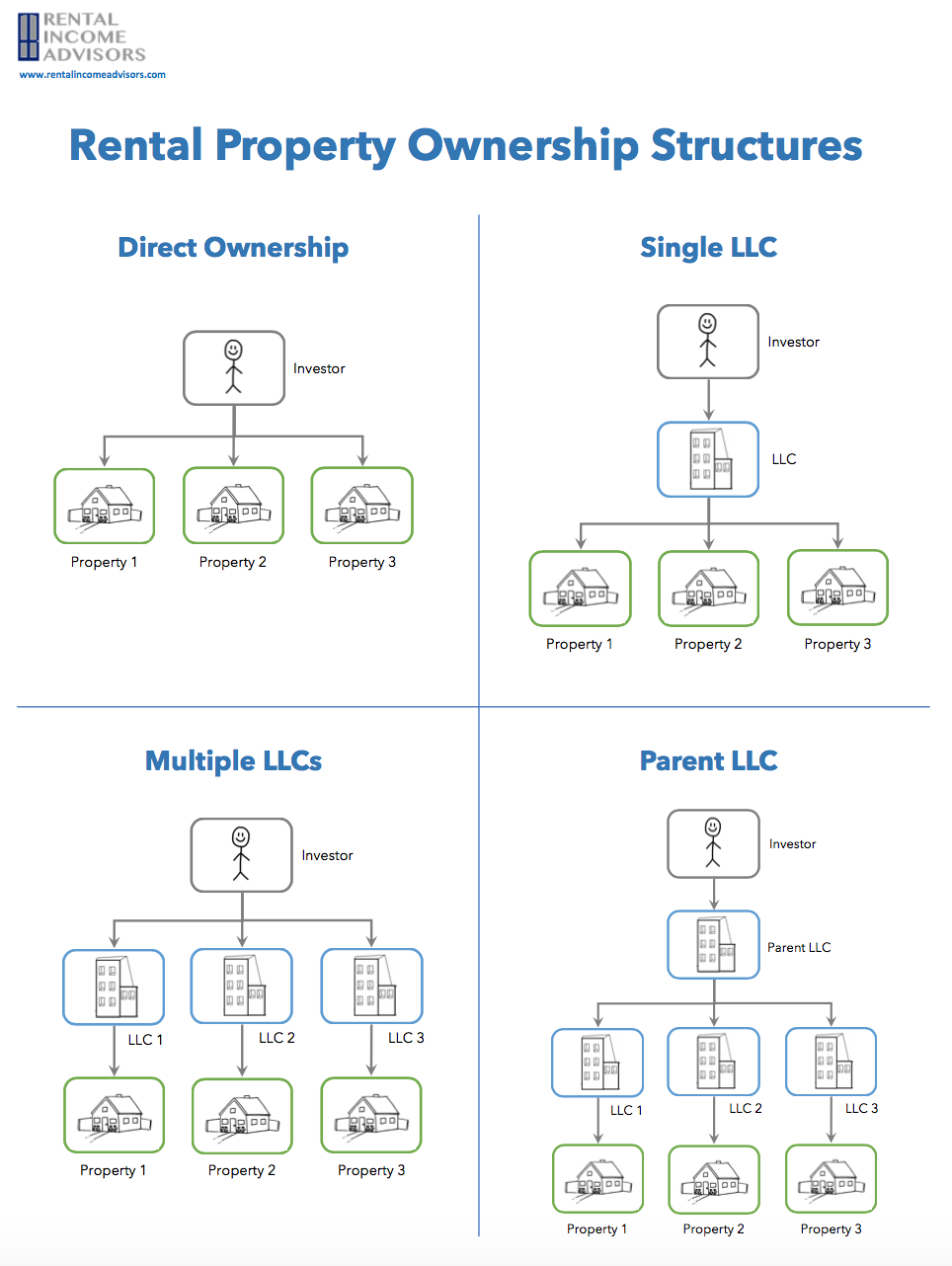

Some investors put each individual property in its own LLC. (“I own several companies that each owns and rents real estate.”) Others go even further by setting up a parent LLC that owns all the other LLCs. (“I own a company that in turn owns several other companies that each owns and rents real estate.”)

As you can see, there are actually several possible business structures from which to choose for your rental properties – here’s what they look like:

If this is all starting to sound a bit complicated, that’s only because it IS complicated. It’s therefore quite reasonable to ask: is all of this added complexity really worth it?

Let’s find out by examining each of the arguments used in support of LLCs, and seeing how well they hold up.

Rental Property LLC Argument #1:

Limit Your Liability

This one seems like a slam dunk – I mean, it’s a Limited Liability Company! It’s right there in the name — how could this one not be true?

Well, it is true, so far as it goes. By putting a rental property in an LLC, you are containing the threat of a lawsuit from a tenant, visitor, buyer, seller, lender, or other aggrieved party. They would be forced to bring suit against the LLC, not against you personally, and assets outside the LLC (i.e. your personal assets) would not be at risk.

Which sounds perfectly reasonable. But there are numerous counterarguments to consider:

You have to balance costs vs. risk. For this approach to work optimally, you’d need to put each property in its own LLC. Why? Because if all your properties are in a single LLC, then the entire portfolio is vulnerable to liability arising from any single property. Given the costs of an LLC, which we’ll discuss later, an LLC for each property starts to get very expensive as you grow your portfolio.

The liability shield isn’t perfect. An LLC’s protections are not ironclad, particularly single-member LLCs. Claimants may attempt to “pierce the veil” of the LLC, arguing that there is no real difference between the company and you. Each state has their own laws governing these situations, and it’s generally a high hurdle to clear – but a single-member LLC holding just one rental property is particularly susceptible to this risk.

You’re already covered. Every homeowner’s insurance policy has liability coverage included. For example, each of my properties has a policy with $1M worth of liability coverage (and you can ask for more). That means that in the unlikely event I am sued and there is a settlement or judgment against me, my insurance will cover the first $1M of that amount.

Umbrella policies are cheap. Not convinced $1M will be enough? You can get an “umbrella” liability policy to augment the coverage in your individual policies. And this is very affordable: a $1M umbrella policy will cost you just a few hundred dollars per year, which would mean you’d be covered for an additional $1M above and beyond the liability in your homeowner’s policy. I used to pay ~$950/year for an additional $2M umbrella policy, which covered ALL of my properties and brings my total liability coverage to $3M. I let that policy lapse a few years ago because I decided the risk was so low (see the next point below), that it wasn’t even worth the small annual premium.

The actual risk of a lawsuit that results in a large judgment is extremely low. There is no such thing as zero risk. But even using Google’s awesome powers, it is quite difficult to find examples of individual “mom & pop” landlords (like you and me) being successfully sued and paying out large judgments. This is especially true for properties that are well-maintained and professionally managed. Keep this in mind: in order for a landlord to be held liable for an injury on the premises, the landlord must have been negligent in the maintenance of the property, and that negligence must be the cause of the injury or incident. That is extremely unlikely to occur in a property that is professionally managed. Also, don’t forget that if you use a property manager, it would be THEIR negligence in play as well — which is why property managers carry their OWN liability insurance, which provides yet another layer of protection for you.

This low level of risk makes sense when you think about it: if you look closely at your homeowner’s insurance, you’ll see that the cheapest part is the liability coverage. And umbrella policies are also very cheap. The only way this liability coverage can be so cheap is if there’s a very low risk that the insurance company will actually pay out against that coverage. It’s clear when you look at their rates: your insurance company is MUCH more worried about a tree falling into your roof than they are about a slip & fall claimant being awarded a million dollars.

Again, it’s a balance of cost vs. risk. Would my assets be better protected if each of my rental properties was in its own LLC? Perhaps, marginally. But how worried am I about someone suing me and winning a judgment against me in excess of $1M? Not even a little bit. And that is not bravado – I am a risk-averse person. But I’m also a logical person, and I recognize that this is a vanishingly unlikely event.

And how much would those LLCs cost me, anyway? I’ll get to that toward the end of the post.

Rental Property LLC Argument #2:

Benefit from Tax Advantages

Most discussions of the tax advantages of an LLC for your rental properties are quite misleading, because they tell you why an LLC is advantageous vs. other business ownership structures, such as a corporation or partnership. They cite things such as pass-through taxation, avoiding double-taxation, simpler record-keeping and filing rules, and so on.

But that is irrelevant information for nearly every rental property investor. After all, nobody is forming a C-corp for their rental properties! The appropriate question to ask is this: what are the tax benefits of an LLC for rental properties vs. owning them in your own name?

There’s a simple answer: there are none.

There ARE significant tax advantages to real estate investing, the biggest of which are deductions and depreciation. I wrote in detail about those advantages in this article. What I did NOT say in that article is that any of those advantages is contingent on forming an LLC – because they’re not. You get them just the same, with or without an LLC.

I own my rental properties in my own name. So I enter my rental property financials on Schedule E of my tax returns, which is specifically designed to report income and expenses associated with rental property. I pay income taxes on any net income that remains after all deductions and depreciation are accounted for.

If I owned an LLC, I would file separate tax returns for the LLC, and the net profits of the LLC would “pass through” to my personal tax returns, on Schedule K-1. I would pay taxes on that profit, which would be identical to the net income from Schedule E. Again, the numbers come out exactly the same either way.

There are only two small exceptions worth noting:

Deductibility of non-property business expenses: if you have an LLC, you can legally deduct business expenses not related to any particular property, such as a home office or office supplies. But these expenses are tiny compared to the annual financials of a property, never mind a portfolio, so it ends up being nothing more than a rounding error.

20% pass-through deduction: as part of the Tax Cuts & Jobs Act of 2017, a new deduction was introduced for “pass-through” tax entities such as LLCs. Qualified businesses may be able to deduct up to 20% of net income from their income taxes. Whether landlords with rental property LLCs qualify for this deduction has been a subject of some debate among tax accountants and lawyers – here’s a detailed discussion of the topic. In short: it’s not certain you could qualify for this deduction simply by forming an LLC. Even if you could, rental properties generally have very little taxable income anyway, thanks to deductions and depreciation, which renders the 20% deduction less valuable or even completely moot. Case in point: I reported almost zero net income on my rental properties last year — and 20% of nothin’ is nothin’.

So the argument that you should form an LLC for the tax benefits is very weak indeed, and often it’s just plain wrong and misleading. One tax implication that is indisputable, though, is that each LLC you form will require its own tax returns to be filed, which will cost you money each year unless you plan to do all those tax returns yourself.

Rental Property LLC Argument #3:

Separate Business & Personal Finances

Another argument I hear is that an LLC is the best way to keep your rental property expenses and finances separate from your personal finances. While I certainly agree that you need clean, accurate accounting of your rental properties’ finances, forming an LLC doesn’t actually have much to do with this.

What DOES make separate finances easier is using a dedicated bank account and credit card for your rental business. But even that isn’t needed to achieve “clean books” for your rentals.

If you form an LLC, you really MUST have a separate bank account and credit card. Without them, your LLC doesn’t look like a real business, and is much more susceptible to the “pierce the veil” claims discussed earlier. So you’d weaken the liability shield that was the whole point of forming the LLC in the first place.

However, if you don’t form an LLC, you can choose whether or not to use separate bank accounts and/or credit cards. Having separate accounts may make it a bit easier to keep track of things, and also allows for automatic feeds of bank and credit card transactions into accounting software that you might use for your rentals (such as Quickbooks, RentalHero, Stessa, or Buildium.)

But it also adds a layer of complexity that isn’t really needed. As long as you ultimately get all your rental property transactions cleanly into a single system of record, you’re fine. For the sake of simplicity, I personally choose not to have separate bank accounts or credit cards. Here’s how I make that work:

I use RentalHero for my rental property accounting, and this serves as the system of record.

I’ve set up recurring monthly transactions for each property (such as rent, PM fees, mortgage payments, etc.) – so these are generated automatically in RentalHero each month.

Throughout the month, any time I use my personal credit card or bank for a charge, I enter this manually into RentalHero. This happens very rarely, and it takes me less than a minute to enter.

At the end of each month, I reconcile my property management statements with RentalHero, adding in any non-recurring charges (such as maintenance & repair work).

That’s it. At the end of that monthly reconciliation, I have a clean accounting of my rental properties’ finances. This takes no more than 15 minutes per month. For me, this is way easier than keeping track of multiple separate bank accounts and credit cards – and it’s perfectly acceptable from a tax & accounting perspective, because I have all the bank, credit card, mortgage, and PM statements to back up what’s entered into RentalHero.

Bottom line: without an LLC, you can choose whether you want separate bank accounts and/or credit cards for your rental properties. You can achieve clean separation from your personal finances either way.

But if you choose to form an LLC, you MUST have separate bank accounts and credit cards. This adds some complexity to your business, comes with costs and complexity, and gives you an outcome – clean, separate books for your rental properties – that is perfectly achievable WITHOUT an LLC, and even without separate bank accounts and credit cards.

Rental Property LLC Argument #4:

Remain Anonymous

With an LLC, you can (theoretically) shield your identity from public view, because when someone goes to look up the owner of the property, they’ll find the LLC’s name, not yours.

However, unless you take specific steps, and incorporate your LLC in certain states, it’s still pretty easy in most jurisdictions to uncover the owner of an LLC. In fact, other real estate professionals who are in the business of buying homes — flippers, turnkey providers, wholesalers, etc. — use increasingly powerful “skip tracing” software to find the owners of LLCs so that they can market to them via phone and text (i.e. “I want to make a cash offer on your house at 123 Main St.”) Forming an LLC will unfortunately not save you from the fate of swatting away this spam.

Also…are you a spy? Do you live a double life? Are you a James Bond villain? If not, there probably isn’t any actual need to hide your identity as owner of a house in Anytown, USA. It’s highly unlikely anyone cares who you are, and any efforts you take are unlikely to deter a motivated person from discovering you anyway.

Rental Property LLC Argument #5:

Split Ownership With a Partner

If you will own the property with one or more partners, an LLC ensures clear and equitable distribution of profits based on the percent ownership of each partner. Doing this without a business structure gets quite complicated: whose account does the rent get deposited into? Who pays for the HVAC repair? It would be a nightmare to keep track of who owes what to whom.

There is no good counterargument here. If you are investing with a partner, it makes good sense to form an LLC. Though it may impact your ability to get financing.

Which leads me back to those three additional reasons NOT to form an LLC…

LLCs cost money, every year, forever

Each LLC you form will cost you money in the following ways:

Initial filing and incorporation fees. These vary by state, but they’re usually a few hundred dollars.

Annual fees. These also vary by state, and run from about $100 to over $500. And that’s every year.

Separate tax returns. These will cost you money, unless you’re doing it all yourself, in which case it costs you time. (Which, as they say, IS money.)

Separate bank accounts and credit cards. These may mean additional fees, though you can avoid these if you’re diligent.

Especially if you’re thinking about a separate LLC for each property, these fees can become quite material over time. These costs need to be weighed against the benefits of LLCs, which as we’ve already seen are quite scant.

LLCs are complicated

Done right, every LLC will require:

Initial filing paperwork

Separate tax returns every year, both federal and state

Separate credit card

Separate bank account

Rent checks made out to different entities, if you’re collecting rent on your own

The same would apply to your property manager, who would have to create a separate account for each of your legal entities so that they can deposit your checks into separate accounts each month.

The bigger your portfolio grows, the more management and maintenance is required for all these moving parts. It sounds complicated because it IS complicated.

LLCs make it much harder to get a mortgage

This may be the biggest problem with LLC’s for the average investor. As I’ve written about before, low-cost fixed-rate mortgages are the rocket fuel for your rental property returns. Forming an LLC will likely make getting a mortgage much harder.

As we’ve learned, an LLC is a business. Banks will generally only make loans to businesses that have a history of income and profit, which your newly-formed rental property LLC will not have. Banks also will generally only make commercial loans to businesses – and those loans do not have the same super-attractive rates and terms you’re used to in a conventional mortgage. The same would be true for other “creative” forms of financing, such as using hard money, private lenders, or seller financing.

Can you buy the property in your own name, and then transfer it into an LLC? Technically, yes. But if you have a mortgage, this may be problematic because the bank has the right to call your loan due on this transfer — meaning you’d have to pay back the full loan balance. (They might or might not actually do this; but they definitely have the right to do it.) If they did so, they might or might not choose to issue a new loan to your LLC, and the terms of that new loan might be less favorable, with a higher interest rate. Converting the property to an LLC might also trigger new taxes, particularly the Title Transfer Tax.

Plus, even if you’re successful in moving your property to an LLC without triggering any of these consequences, what if you want to refinance your mortgage in the future to take advantage of lower rates or cash out your equity? With your property in an LLC, you very likely won’t be able to.

Bottom line: you definitely want conventional mortgages for your rental properties, because they can supercharge both your cash flow and your long-term wealth-building. You can get up to 10 conventional mortgages for investment properties (or 20 with your spouse), and there’s a good reason these are called your “golden tickets!” But if you form an LLC for your rental property, you may find it nearly impossible to get a mortgage, and transferring a mortgaged property to an LLC post-purchase may also be highly problematic.

Conclusion

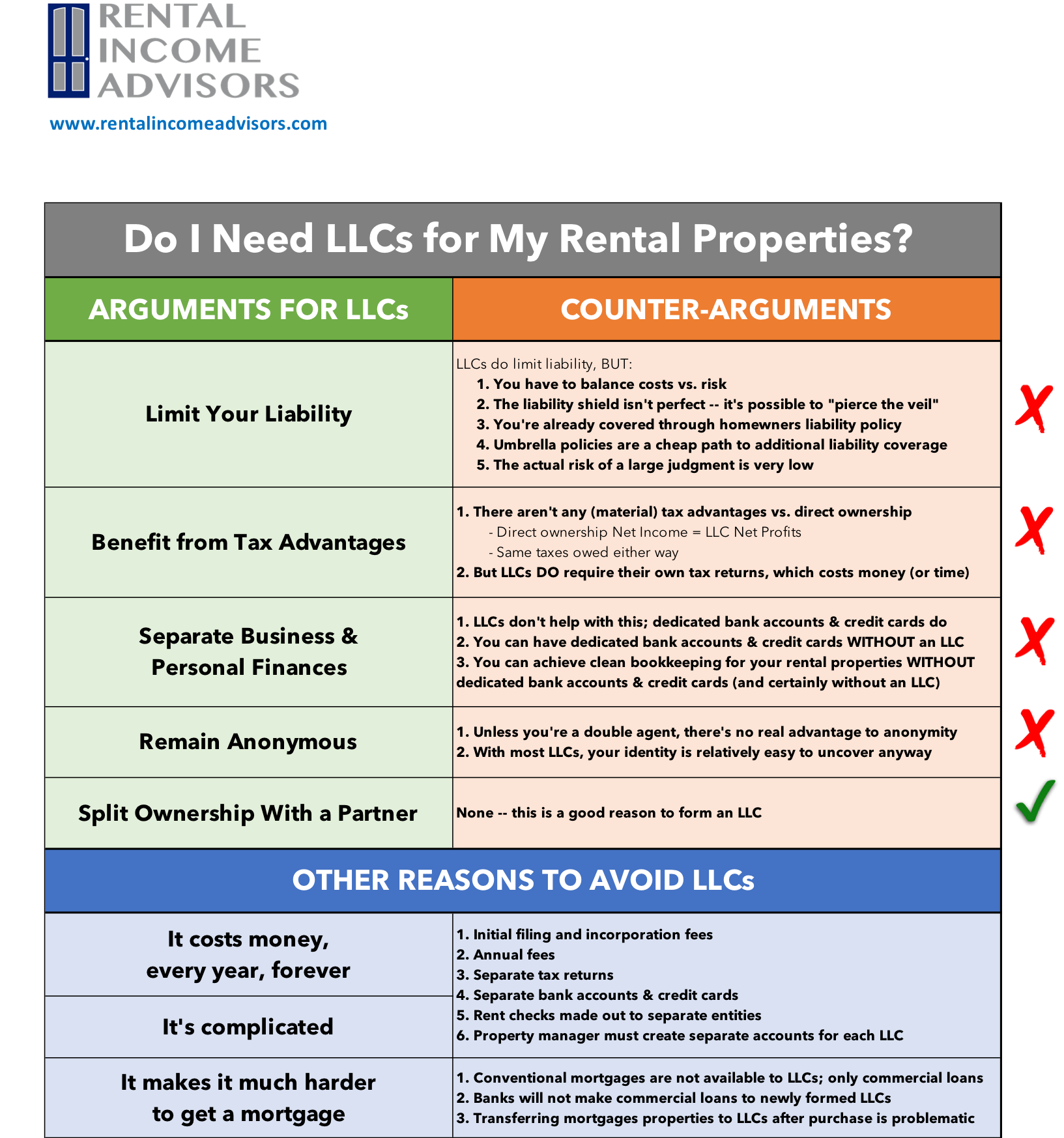

Phew! We’ve covered a lot of ground. Here’s a summary of this (looonnnggg) discussion, in a handy-dandy visual format:

The key takeaways are:

Talk to accountants and lawyers about the pros and cons of LLCs for your rental properties. But when you do, don’t forget the “hammer and nail” problem.

The arguments most frequently used in favor of forming LLCs are not as strong as they seem to be, and do not hold up to serious scrutiny.

Creating LLCs creates long-term costs and complexities that should not be underestimated.

Creating LLCs makes it more difficult to obtain conventional mortgage financing, which represents a huge lost opportunity for most investors.

Free Rental Property Analyzer

An Excel rental property calculator is the most important tool you have as a rental property investor. It lets you answer questions like:

Which of my target properties offers the best returns?

What will my monthly cash flow be, on average?

What impact will getting a mortgage have on my cash flow, and my cash-on-cash returns?

What will my total returns be after 10 or 20 years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple & intuitive to use. Check it out!

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.