Monthly Portfolio Report: August 2020

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for August 2020.

Property Overview

Maintained full occupancy this month, and no vacancies on the horizon. Wheeeee!

Rents

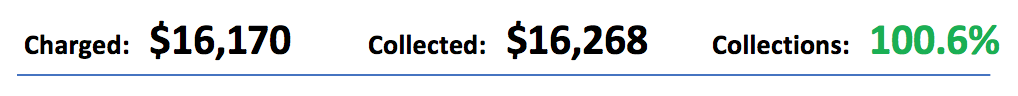

Fully collected this month, plus a little extra from one tenant who was a bit short last month.

I continue to wait for the other shoe to drop with respect to the pandemic, and impacts on my tenants’ ability to pay rent. But so far, I haven’t noticed any change in collections, or even in tenants paying later than normal. I’m still concerned, though, because the federal unemployment assistance expired over a month ago; it’s still unclear at this point whether Congress will reach an agreement on further aid.

Expenses

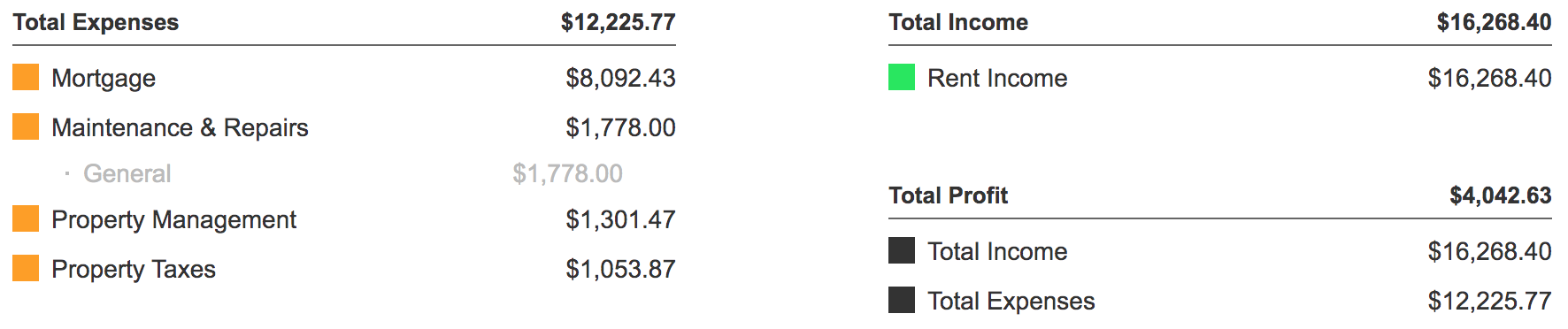

A few explanations for expenses this month:

Mortgage: My mortgage payments have settled out after the annual escrow adjustments and refunds, so this should be the new regular amount. It’s exactly $0.48 higher than the monthly amount in April/May, before all the adjustments, so…much ado about nothing.

Maintenance & Repairs: These costs were a bit higher than average, mostly due to HVAC repair visits at three different properties. I also had one small plumbing issue, a broken garage door, and the cutting & removal of part of a tree that had died.

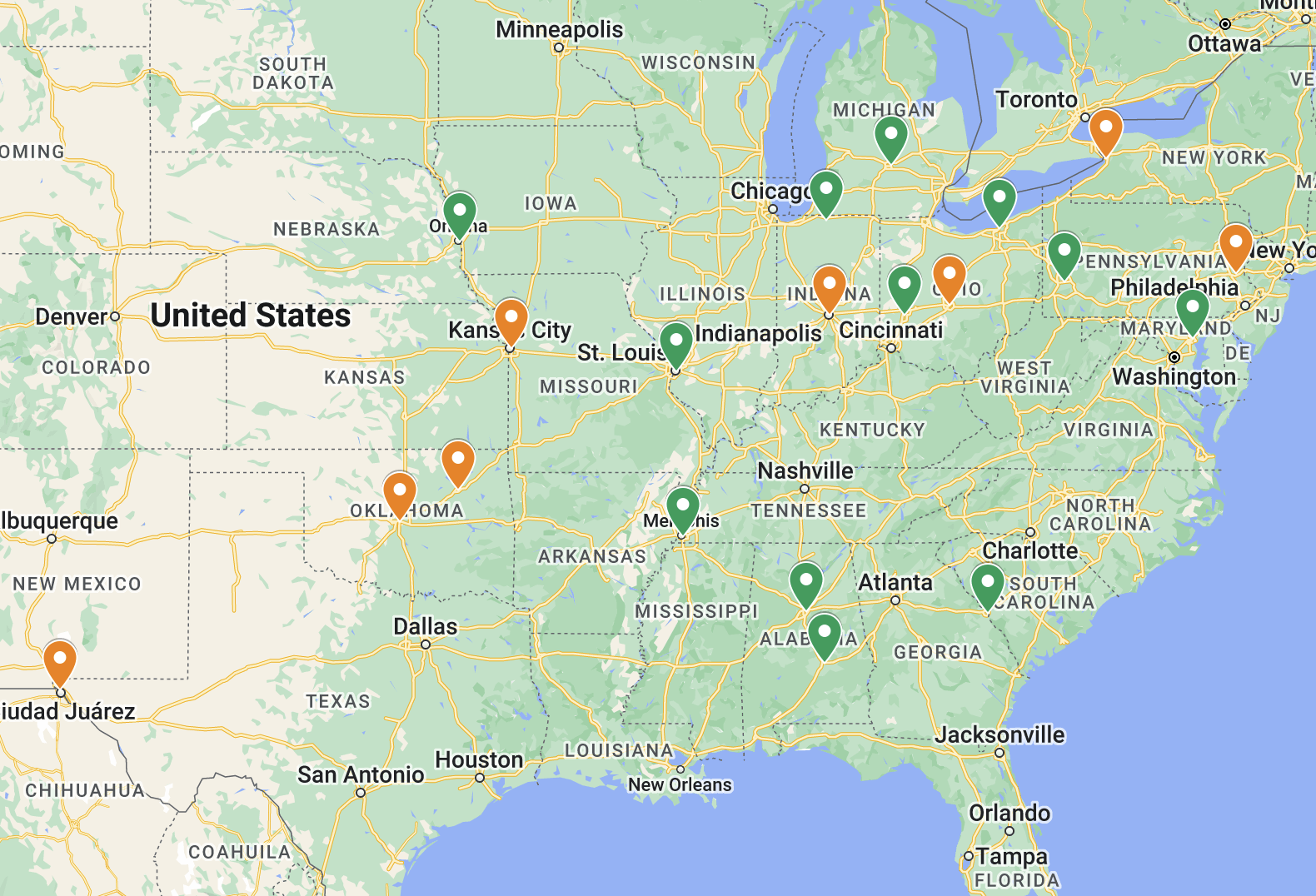

Property Taxes: Most of my property taxes are paid out of escrow accounts by my mortgage lenders — meaning the costs are baked into the monthly mortgage payments. But there are three houses I own free & clear, and for those I have to pay taxes directly. In August, I paid 2020 Memphis city taxes for those three properties; the Shelby County taxes will be paid in January.

The Bottom Line

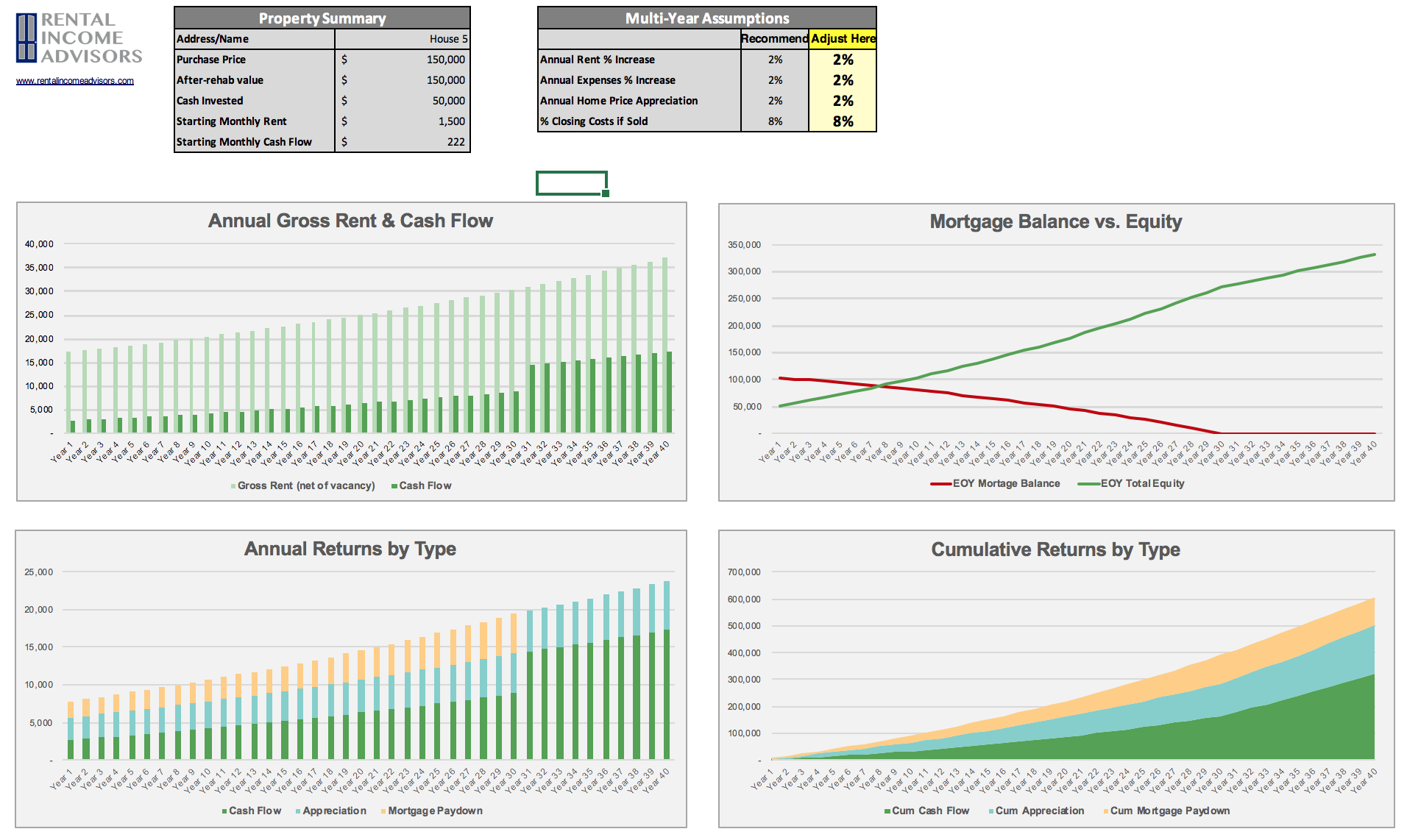

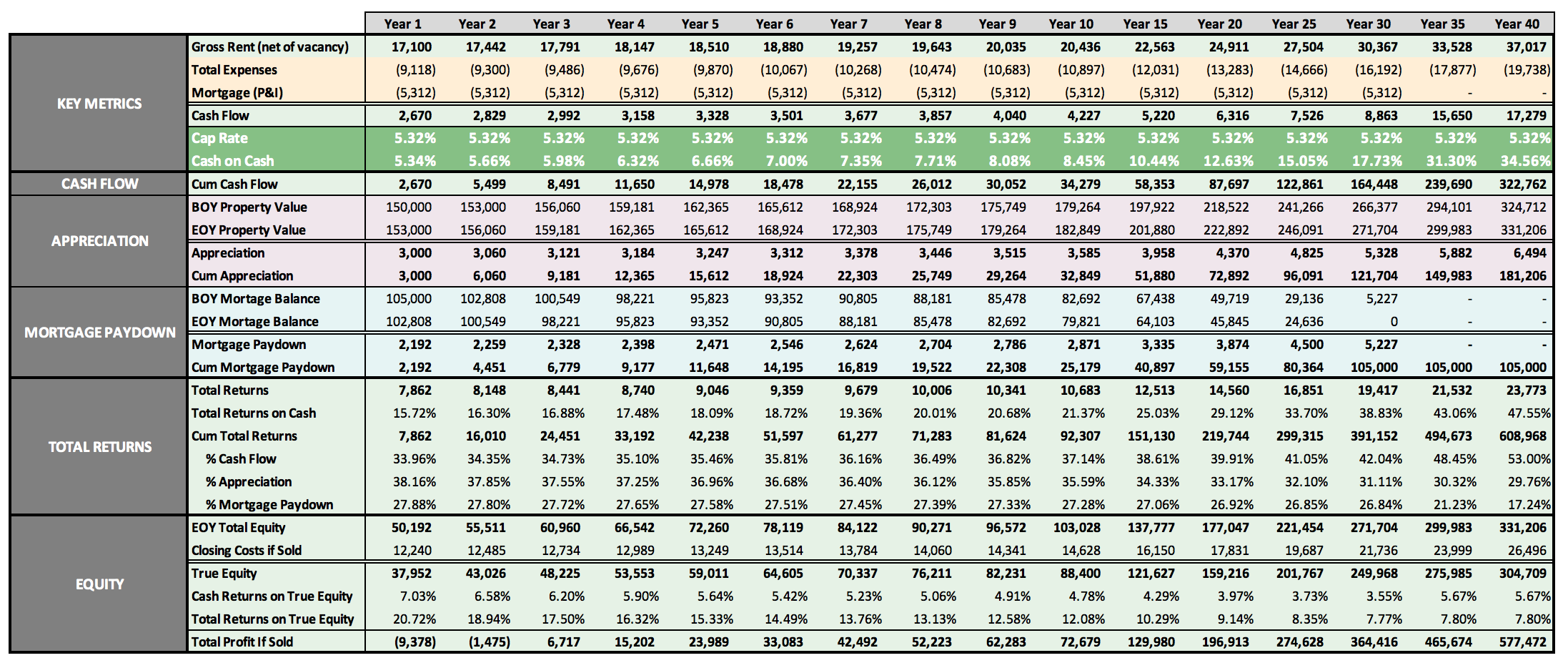

My financial model projects my Memphis portfolio to generate $4,329 per month in positive cash flow. In August, the positive cash flow was $4,042, which is ~$300 less than expected. I paid over $1K in property taxes out of pocket, and repair costs were a bit high; but this was offset by having no current vacancies and 100% collections. (Recall that in any good expense model, you have a budget line item for vacancies, so any month with zero vacancy results in a “bonus” vs. your projections.)

Finally, here’s the running tally and graph I update each month. This is the first month to fall “below the line”, but that’s to be expected — remember, the model projects the AVERAGE monthly cash flow, not the minimum. And overall, this isn’t too bad given my property tax bills this month.

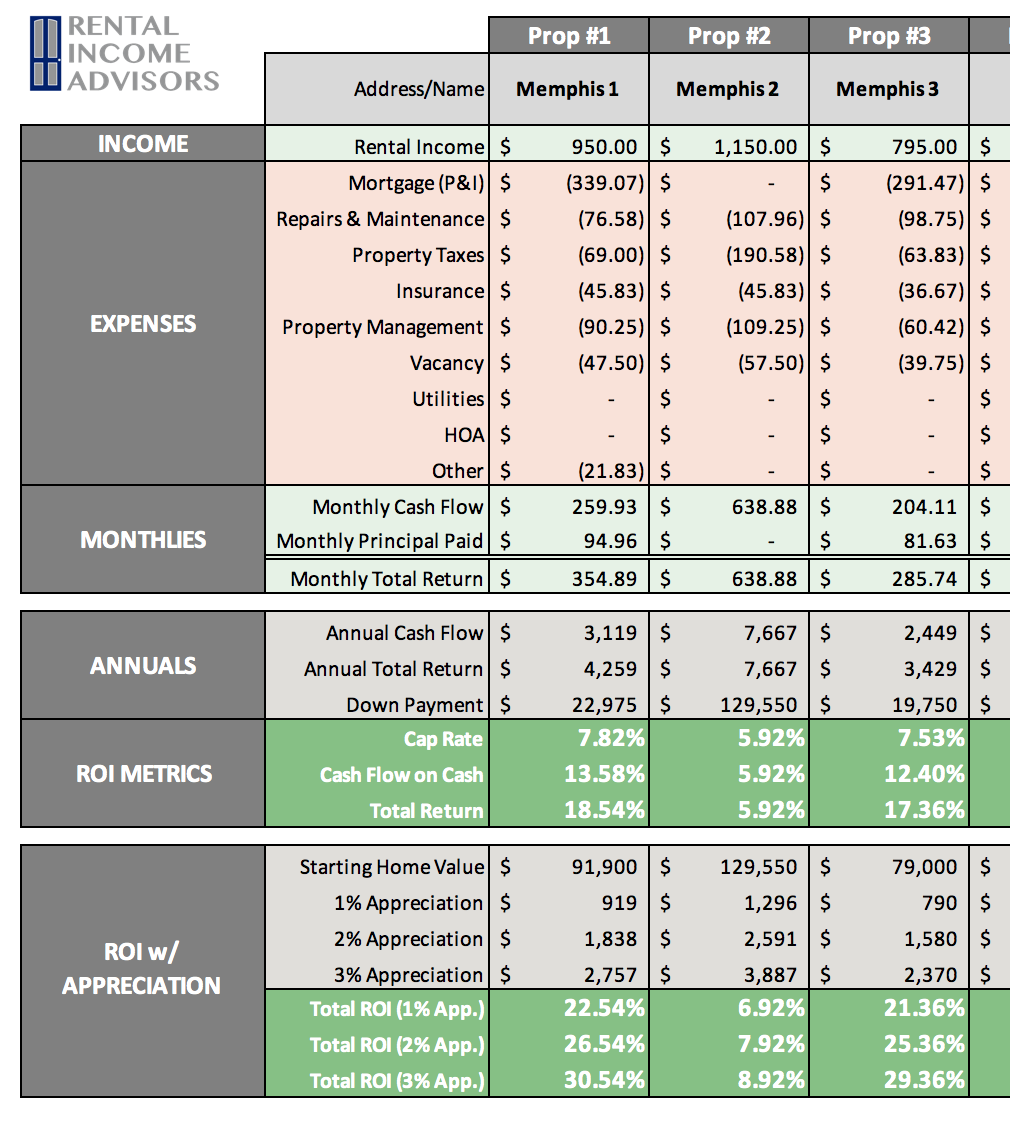

Free RIA Property Analyzer

Need help running the numbers on your own properties? Get the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.