Monthly Portfolio Report: October 2020

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for October 2020.

Property Overview

I’m still fully occupied this month, with no known vacancies on the horizon. Love that!

Memphis Property #17 is included in my monthly numbers starting this month. I’m still in contract on Property #18 (indicated by the red pin on this post’s thumbnail image) but the closing was delayed a bit due to problems getting the appraisal scheduled. More to come on this property — it’s my first duplex, and my first property that needs significant work before being rent-ready.

Rents

Fully collected this month, with a few extra dollars as a bonus!

The pandemic continues to ravage the economy all over the country. Though I’ve been fortunate not to see any negative impacts so far, it has been several months since federal aid ran out, and cases are spiking all over the country, including in Tennessee. November rents are not yet collected from four of my tenants, which is more than usual at this point in the month. Time will tell if that’s the start of a negative trend, or just a blip. Fingers crossed….

(UPDATE: all four tenants paid their rent within a few days of original publication. So perhaps it was just a blip.)

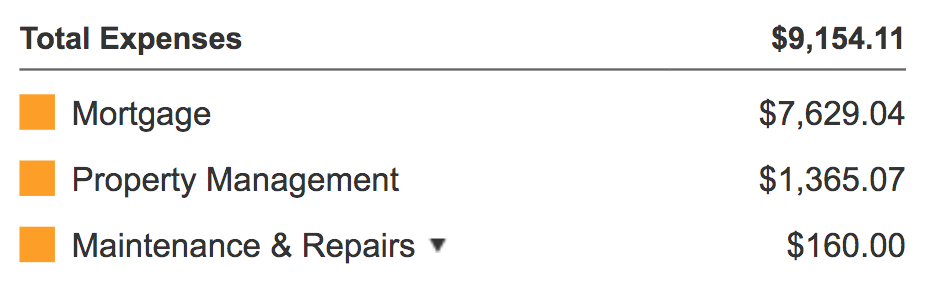

Expenses

It was a really good month in terms of expenses:

Maintenance & Repairs: A remarkably good month here, with only a single maintenance visit across my entire portfolio. Keep in mind that my financial model budgets over $1,400 per month in maintenance & repair costs, so $160 is about as good as it’s ever going to get!

Mortgage: I was the beneficiary of another escrow refund check, which reduced my net mortgage payment on one property by over $400. That’s why the total mortgage expense is lower than last month. Further, my newest property (Memphis Property #17) closed in September, which means the first mortgage payment is not due until November — so I had the benefit of October rent at this property without a mortgage payment.

The Bottom Line

My financial model projects my Memphis portfolio to generate $4,520 per month in positive cash flow. In October, the positive cash flow was $7,909, which is well over $3K more than expected. This was a result of VERY low maintenance costs this month, along with full occupancy and 100% collections. (Recall that in any good expense model, you have a budget line item for vacancies, so any month with zero vacancy results in a “bonus” vs. your projections.)

Finally, here’s the running tally and graph I update each month. You can see that this month absolutely crushed my projected average monthly cash flow, indicated by the dotted blue line. This was basically a perfect month, so I expect this will the high water mark on this graph for a long time to come!

Free RIA Property Analyzer

Need help running the numbers on rental properties? Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties.

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.