Do Condos Make Good Rental Properties?

Last updated: 2024

Over the years, I’ve been asked many times about condos as investment properties. (These are called “condominiums” in the King’s English, but I’ll be sticking with “condos”, since I’m paid by the word, not by the letter. That last part is a joke, of course — I’m not paid at all!) Anyway, given the questions I’ve been getting, I thought it was high time to put together an article that addresses the topic in detail.

If you’re a regular reader of the blog, you might be surprised to learn that I actually have some personal experience with rental condos. Years before I discovered the awesome cash flow possibilities of out of state rentals, I purchased three condos in my hometown of New York City, and another one in its northern suburbs. My strategy was to buy newly built studio or 1-bedroom condos in up-and-coming neighborhoods, avoid negative monthly cash flow (breaking even was the goal), and be lifted by the tide of gentrification and rising prices while my tenants paid off my mortgages.

In other words, I made a speculative bet on price appreciation. (Yup — basically everything I advise AGAINST nowadays! But hey, we were all young and foolish once, right?)

Still, I managed to get reasonably lucky: the condos were consistently rented with good tenants, and they appreciated a bit. So my plan sorta worked. Why, then, did I ultimately sell my condos and reinvest in cash-flowing properties out of state?

You might guess it had something to do with the pandemic, which brought New York City real estate to a near standstill earlier in 2020. Demand took a nosedive, and prices followed. Was I spooked by the covid crash?

Nope. In truth, I had already decided to sell the condos before the pandemic hit, for two big reasons. First, my strategy has shifted – instead of rolling the dice on appreciation, I now want strong, steady monthly cash flow. I’m fully convinced this is a strategy that offers superior returns, PLUS the freedom that comes with passive income. Second, I’ve learned a lot over the years about condos as rental properties, and I’ve determined that even if they DID cash flow, the cons would still outweigh the pros. (Update: going against my own advice years after this article was originally published, I did buy two condos in my cash flow market of Memphis — Property #24 and Property #25 — but these were very specific circumstances in which the cons I outline below largely did not apply.)

In this article, I want to dig into the pros and cons of condos as rental properties, so that those who are considering condos for their portfolio have a good framework to make that decision. Along the way, I’ll share some “True Life” stories that illustrate the good, the bad, and the ugly of owning condos as rental properties. (Yes, I am shamelessly using MTV’s intellectual property in this article. I will know I’ve hit the big time when I receive a cease and desist letter from MTV’s lawyers…)

One more quick thing…

Want more personalized help with investing decisions like this one? You’re not alone — this is one of the many decisions I help my private coaching clients navigate as I help them to acquire their own rental properties. In fact, I’ve helped my clients purchase HUNDREDS of properties over the years that are now generating cash flow and building wealth for them. Schedule a free consultation if you’d like to chat with me about rental property coaching, or learn more about my coaching program & structure.

OK, let’s get into the pros and cons of condos! But first things first. Let’s answer what might seem like an obvious question: what is a condo?

The Basics of Condos

A condo is a shared living arrangement in which individual units are separately owned, and common areas are jointly owned. Each owner has a fractional interest in the common areas, and pays a monthly maintenance fee to contribute to the upkeep of those common areas, including amenities such as a gym, pool, lounge, and the like that may be offered to residents. Individual owners are therefore directly responsible only for the space inside their unit (often called “walls in”), while the common areas are maintained by the condo. Most condos are constructed as multi-story apartment buildings or attached townhomes, though a few are “detached condos” comprised of single-family homes.

A condo’s operations and finances are managed by a Homeowners Association (HOA) or condo board. This body makes and enforces various rules for condo owners and residents, and also determines how much owners are responsible to pay in monthly fees. They’re also responsible for ongoing maintenance and operations, but they will typically hire a third-party management company to handle the day to day tasks and staff the condo as needed.

These are the two most important things to remember about condos as rental properties, and they will come up repeatedly in the pros & cons discussion below:

As an owner, you are only responsible for “walls in”, and the rest is handled by the condo

The HOA/condo board controls critical aspects of the condo’s operations and finances that can significantly impact your profitability, and over which you have no control

The Pros of Condos as Rental Properties

Though I don’t recommend condos as rental properties, they inarguably offer some benefits to investors. These are the most important ones:

Lower Maintenance & Capex Costs

Because owners are only directly responsible for the space inside their unit, condos typically have lower repair and maintenance costs. They also have very few (if any) capex costs for owners, because those are borne by the condo itself.

Easier to Manage

When I first bought my condos, I was attracted to the idea that it would be easy to own – after all, there’s no lawn to mow, and no roof to worry about replacing. I wanted as few headaches as possible, and condos truly are quite attractive in this regard. Some condos even employ maintenance staff whom tenants can contact directly with small issues. It follows, then, that condos are more feasible for owners to self-manage, rather than using a property manager, which translates into further expense savings.

True Life: I Manage My Own Condos

I have always self-managed my condos — though I should note that New York City is one of the few markets where brokers are routinely involved in rental transactions, which means my broker does all the work to find, screen, and place new tenants. In places where this isn’t the case, I would still recommend a property manager, even for condos.

Read more about this: What Does a Property Manager Do?

Cheaper Insurance

One additional consequence of “walls in” ownership is that insurance is cheaper for condos than for comparably priced single family homes. This makes sense when you think about it: if a common element is damaged – say, the roof needs to be replaced due to a hailstorm – it would be the condo’s insurance policy, not yours, that would be in play.

True Life: My Condo Insurance is Dirt Cheap

This price differential between condo policies and typical homeowners insurance policies can be pretty significant: I paid only ~$400/year to insure my condos, which were each valued above $400K, while I pay ~$700/year to insure a house in Memphis worth only $100K.

Lower Purchase Price (Usually)

In most markets, condos are cheaper than single-family homes, providing investors a lower barrier to entry and better price-to-rent ratios. However, in the densest and most expensive urban markets, such as New York City and San Francisco, condos are often the MOST expensive housing type.

Desirable to Tenants

The “condo life” can be very appealing to tenants – they, too, have less maintenance to worry about, and can take advantage of the common areas and any amenities offered by the condo. This means stronger rental demand among high-quality tenants who will be attracted to a gym, pool, roof deck – or even just the convenience of a package room.

Free Rental Property Analyzer

If you’re considering condos, an Excel rental property calculator is the best way to be sure the numbers work. For example, you might want to see:

How much does a condo’s lower maintenance and insurance costs save you vs. single-family homes?

Will the monthly HOA fee eat up all your profits, or will you still be able to generate healthy cash flow?

What impact would a special assessment have on your long-term returns?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!

The Cons of Condos as Rental Properties

Despite the benefits outlined above, I’ve come to appreciate over years of owning condos that the drawbacks are just as numerous, and more impactful. Here are the major factors that make condos problematic for investors:

Monthly HOA Fees

Sometimes called condo fees, maintenance fees, or common charges, this is the monthly amount owed by each owner to support the upkeep of the condo’s common elements.

There are two main problems with HOA fees. First, they’re high. This monthly expense can run in the hundreds of dollars, and can more than negate any benefit you might get from lower maintenance and insurance costs. They may even wipe out any positive cash flow you might otherwise get from the property. The commonly used “1% rule” can be deceptive with condos — even when monthly rent is at least 1% of the purchase price, the HOA fee may eat up most of your returns. Be sure you run your numbers carefully to arrive at an accurate estimate of your cash flow, cap rate, and cash-on-cash returns.

Read more about this: Estimating Rental Property Expenses

The second problem with HOA fees is that they only move in one direction — up. Each year, the HOA will evaluate the financial needs of the condo, and increase the fees by a small (or sometimes not so small) percentage.

True Life: My Condo Fee Goes Up…and Up

Here are the actual monthly fees for a condo I purchased in 2015. In five years, it increased over 42%:

Leasing Fees

Many condos will also charge you a separate annual fee to lease your unit. These can vary widely, but a leasing fee equal to 1 or 2 times your monthly HOA fee is common. This is just one more drag on your cash flow and profits.

True Life: My Leasing Fee Doubles for No Reason

For the suburban condo I bought in 2017, the leasing fee was originally equal to one month’s HOA fee. But by the following year, the board had changed the policy and doubled the leasing fee to two month’s HOA fee. I asked to be grandfathered in based on the policy when I purchased the condo, but they declined. So I was on the hook for another $350 per year – every year — that I hadn’t counted on.

Want to know the worst part? Their goal in changing this policy was explicitly stated: to make the condo LESS attractive to investors. They wanted to maintain a certain level of owner-occupants in the complex, and soaking investors with fees is one way to drive them out.

Special Assessments

The “special assessment” is the dreaded boogeyman of condo ownership, who comes in the night to devour your profits.

Here’s the deal: in addition to your monthly fee, the HOA/condo board may determine that a larger, more immediate cash infusion is needed, either to strengthen the condo’s financial position for the future or to pay for an immediate upgrade, investment, or capital expense. To raise that needed cash, they simply send a bill to the owners. These special assessments can be quite large – thousands of dollars per owner is not unusual, and they can even run into the tens of thousands in more expensive condos.

The condo may choose to collect the assessment in one chunk, or collect it incrementally over a period of months or years by adding it to the monthly fees. Like monthly fees, special assessments are charged proportionally based on each owner’s fractional share of ownership of the common elements, such that owners of larger units pay more. Also like monthly fees, there’s basically nothing you can do about this as an owner – you have to pay. Failure to pay will eventually allow the condo to foreclose on your unit. And of course, if you try to sell the condo, any special assessments must be disclosed, and this can make buyers run for the hills.

Needless to say, a large special assessment can completely consume your expected returns (and then some), and also make the condo more difficult to sell. This is why the HOA/condo board’s ability to assess owners is perhaps the riskiest part of owning a condo as a rental property.

Rental Restrictions

Boards of condos may also establish restrictions on your ability to rent your unit. Again, the goal of these restrictions is to discourage investors in favor of owner-occupants – for a variety of reasons, boards don’t want the condo community to become dominated by renters.

Some condos restrict how many total units can be rented, which could threaten your ability to lease your unit over the long term. If too many owners start to rent, the board may decline your request to renew your tenant or bring in a new tenant after a vacancy. Other condos may only allow owners to rent starting one year after purchase, which discourages investors from buying in the first place.

Even if a condo has no such rules in place when you purchase, they may still choose to establish them in the future, and you would then be subject to the new rules.

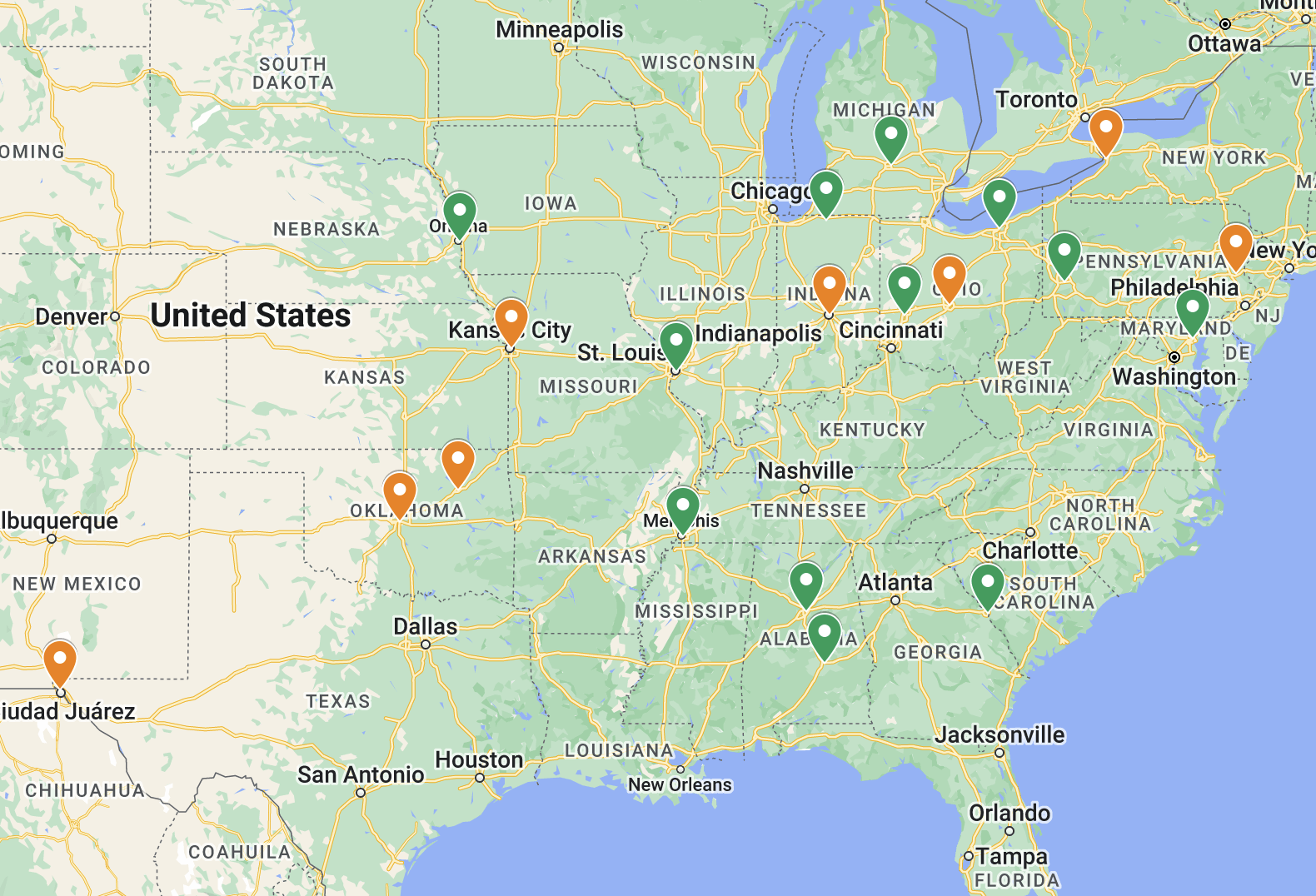

True Life: Condos Don’t Like Investors Much

When I was shopping for condos in the NYC suburbs, I was expecting to buy quite a few of them, because the numbers worked pretty well. However, I discovered that nearly all of the condos had restrictions in place that prevented owners from renting until a full year had passed – and those that didn’t were moving in that direction. I did ultimately purchase one unit in a condo that did not (yet) have this restriction on renting, but I realized this was not a stable or scalable investing strategy due to how unfriendly the condos were to investors. That’s when I pivoted to out of state single-family homes, ultimately deciding on Memphis as my investment market.

Frustrating Rental Process

Even when you DO have authorization to lease your unit, the process can be long and grueling. Most condos will require management approval for all tenants, which means lots of additional application paperwork for both you and your prospective tenants.

True Life: I Lose a Tenant

The application process can range from smooth to excruciating, depending on how the management company and the board operate. In one of my NYC condos, the process is ESPECIALLY painful, and it takes several weeks for tenant applications to be reviewed and approved. In one instance a few years ago, this delay caused me to lose a qualified tenant. His application was good, and he had paid all the requisite fees and deposits, but he needed a place to live ASAP and simply couldn’t wait. I did everything in my power to put pressure on the management company to move faster, but to no avail. The prospective tenant walked, and it took me another 6 weeks to find a new one.

Harder to Get Financing

Lenders also have additional requirements when making loans to condo owners. In particular, lenders always want to see a clean financial bill of health for the condo itself. If the condo has a lot of deferred maintenance, or a lot of debt, or a lot of uncollected monthly fees, that means a greater chance of large owner assessments in the future, which could impact the borrower’s ability to pay back the loan.

Further, lenders generally require that at least 50% of the condo’s units are occupied by owners. Any less than that, and they’re reluctant to make loans at all. This is one of the main reasons why HOA/condo boards are often so keen to keep investors out. They monitor this ratio closely, and will take action if the percent of owner-occupants falls too close to that 50% threshold — because if lenders won’t give mortgages to prospective buyers in their condo, that will significantly depress their property values.

Problem Resolution Can Be a Headache

In condos, there are sometimes issues affecting your tenants that you can’t solve on your own. In those cases, you have to appeal to the management company and/or the board, and they may not share your urgency in getting the issue resolved.

So in addition to giving up control of many financial aspects of your property with a condo, you’re also giving up the ability to ensure a great experience for your tenant. With a single-family home, by contrast, you’re in complete control.

True Life: Condo Issues Are a Pain

What kinds of things can come up in condos that you can’t directly address? Here’s a sampling – these are all real-life situations that I’ve had to deal with in my condos:

“It’s been a week. When are they going to fix the elevator?”

“I smell cigarette smoke in the hallways and it’s coming into my apartment.”

“I’ve been seeing roaches in the stairwell.”

“My heat keeps going in and out – and other people are having the same problem.”

“They lost my package. Can I get reimbursed?”

Conclusion

While condos may seem appealing as investment properties due to their lower maintenance costs and ease of management, you surrender a great deal of control. In the end, you are fully at the mercy of the HOA/condo board with respect to fees, assessments, the rental process, redressing issues, and even your right to lease your unit.

In my view, that lack of control represents a huge risk to condo investing that simply does not exist with single-family and small multi-family residences. That’s why, even if my condos DID cash flow well – and they didn’t – I would nonetheless have sold them, and reinvested in properties over which I have fuller control.

Read more about Single Family vs. Multi-Family

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.