Monthly Portfolio Report: May 2023

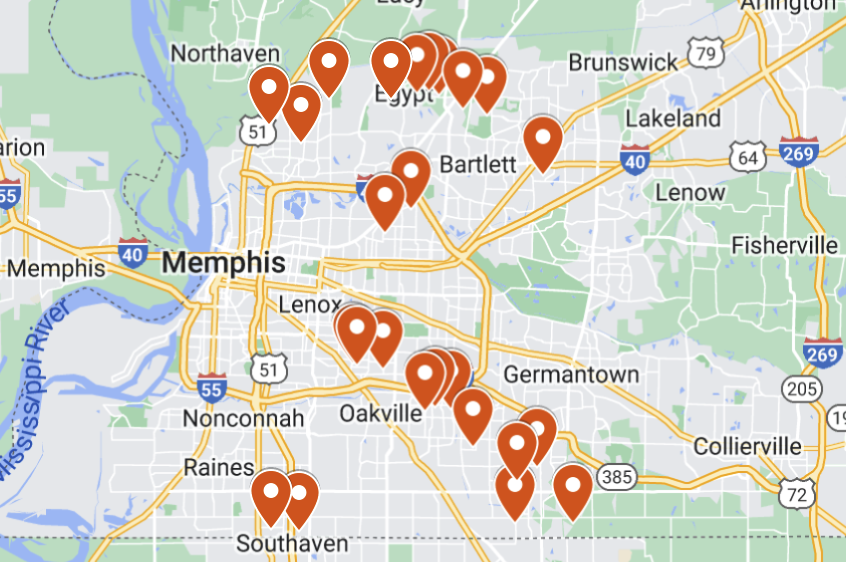

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for May 2023. You can also check out all my previous monthly reports and annual reports.

Property Overview

As I discussed in last month’s report, the new tenant at Property #4 — where I had a lease break and turn this spring — moved in this month, which officially brought me back to full occupancy. We love to see it!

That doesn’t necessarily mean that everyone is paying, however…as I discuss below.

Rental Income

The tenant as Property #20 continues their nonpayment, which is why I have a $1,095 shortfall in collections this month. Eviction proceedings continue for this tenant, but the originally scheduled court date was pushed because the tenant filed for bankruptcy. I’d prefer not to have the delay, of course, but bankruptcy laws are important, and the tenant has every right to avail themselves of those protections.

My PM has agreed to cover the rent during the eviction due to it being a tenant they just placed a few months ago, but I haven’t seen those payments yet. When I do receive them, it will book as a rent collection surplus.

The other tenant (in my duplex, Property #18) having payment issues that I’ve been tracking in these updates seems to have caught up a bit — still paying late, but by mid-month for their June rent. So hopefully their situation has stabilized.

Expenses

This screenshot comes from RentalHero, the online accounting tool I use for my portfolio.

Here are the highlights with my expenses this month:

Maintenance & Repairs: It was a very quiet month except for one large expense: a $3,000 repair of the electric box, meter, and cables on the back of Property #22, which was damaged by a falling tree during a windstorm. FUN FACT: In Memphis, this equipment is not owned by the local utility, but by individual homeowners. So when it’s damaged, I have to replace it — but in this case, I was also required to upgrade the WAY it was affixed to the home to meet current standards, which increased my costs significantly. On top of all that, the trees that threaten these power lines are behind my property on vacant land, and the utility also does not regularly trim/cut trees that could fall on the lines, so this could certainly happen again. It all seemed ridiculous to me, but I had no choice. Thanks, Memphis Light, Gas & Water!

Property Management: These costs were higher than normal due to a $600 leasing fee for the tenant placement at Property #4.

Legal Fees: The eviction filing fee for Property #20 was $350.

Utilities: During turns while properties are vacant, I am responsible for paying the utility bill (or more precisely, my PM pays the bill, and charges me back for it.) This month I had the final utilities costs from Property #4 prior to the tenant moving in.

The Bottom Line

My financial model currently projects my Memphis portfolio to generate $8,903 of positive cash flow in an average month. This month, my cash flow was $8,413, just short of my projected average. While I did have full occupancy, the factors that impacted me negatively this month were:

Nonpayment at Property #20 (again, I’ll get this back eventually)

Leasing fee and eviction fee

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. I continue to run slightly below my cumulative projected cash flow for the year, but I’m still hopeful I can make that up in future months:

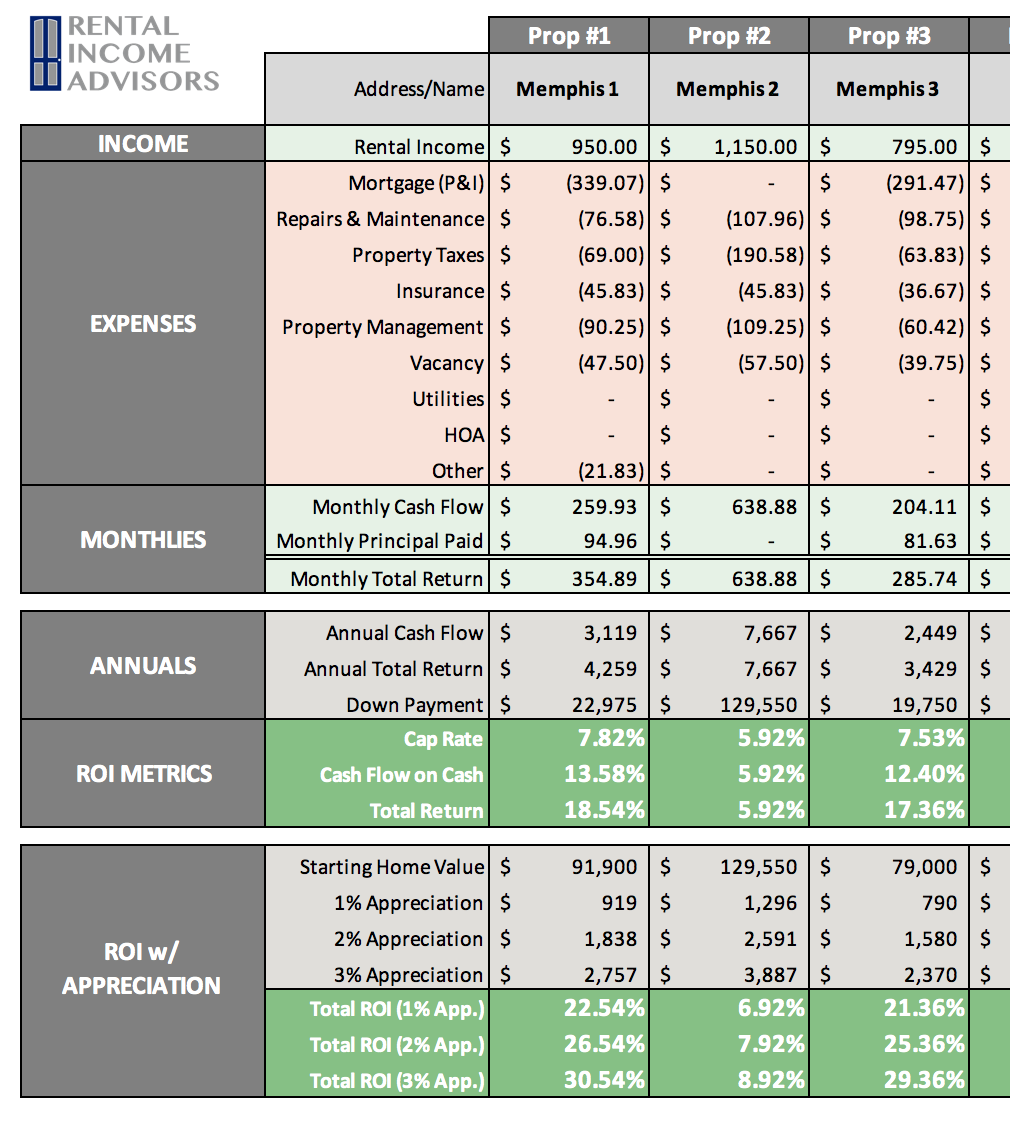

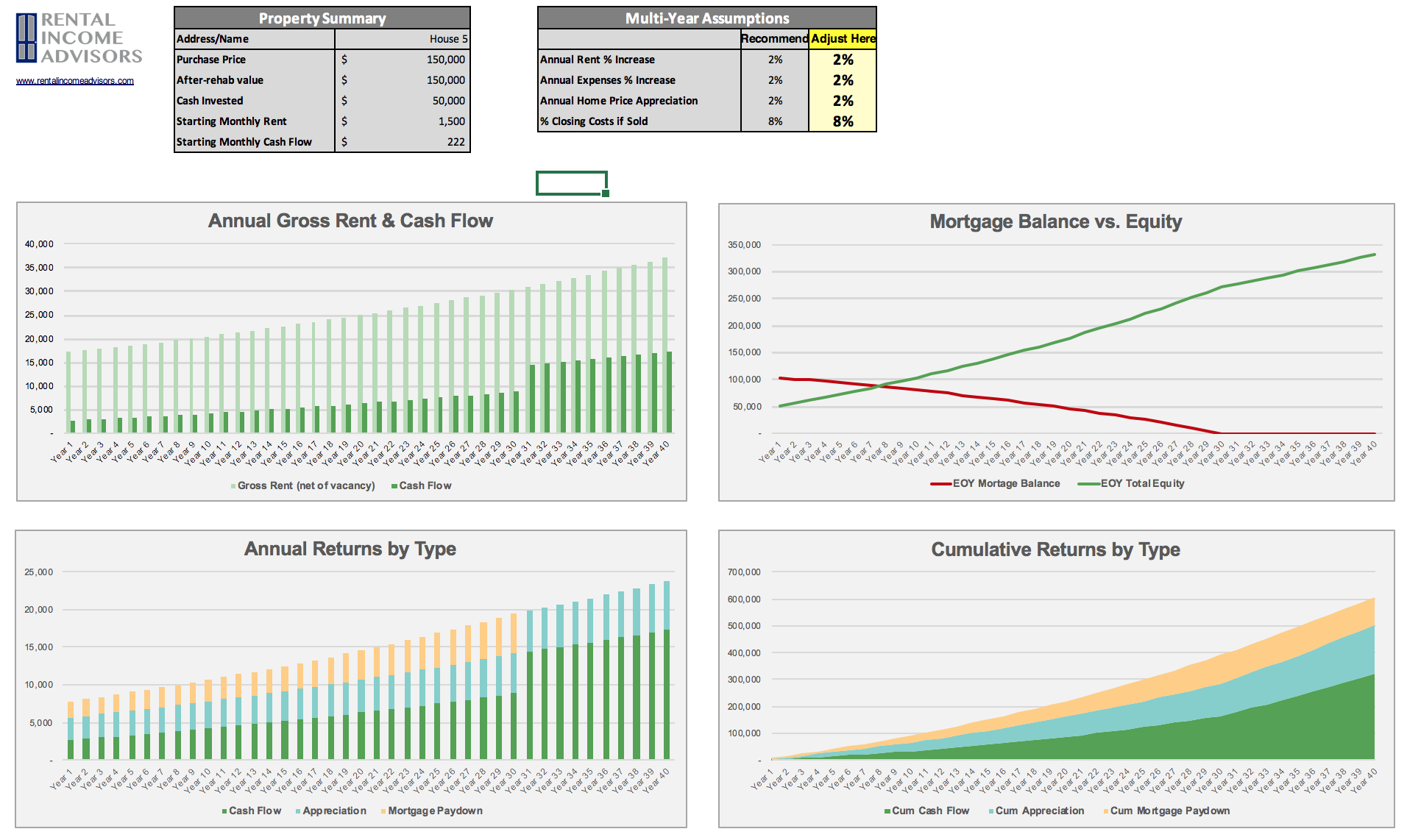

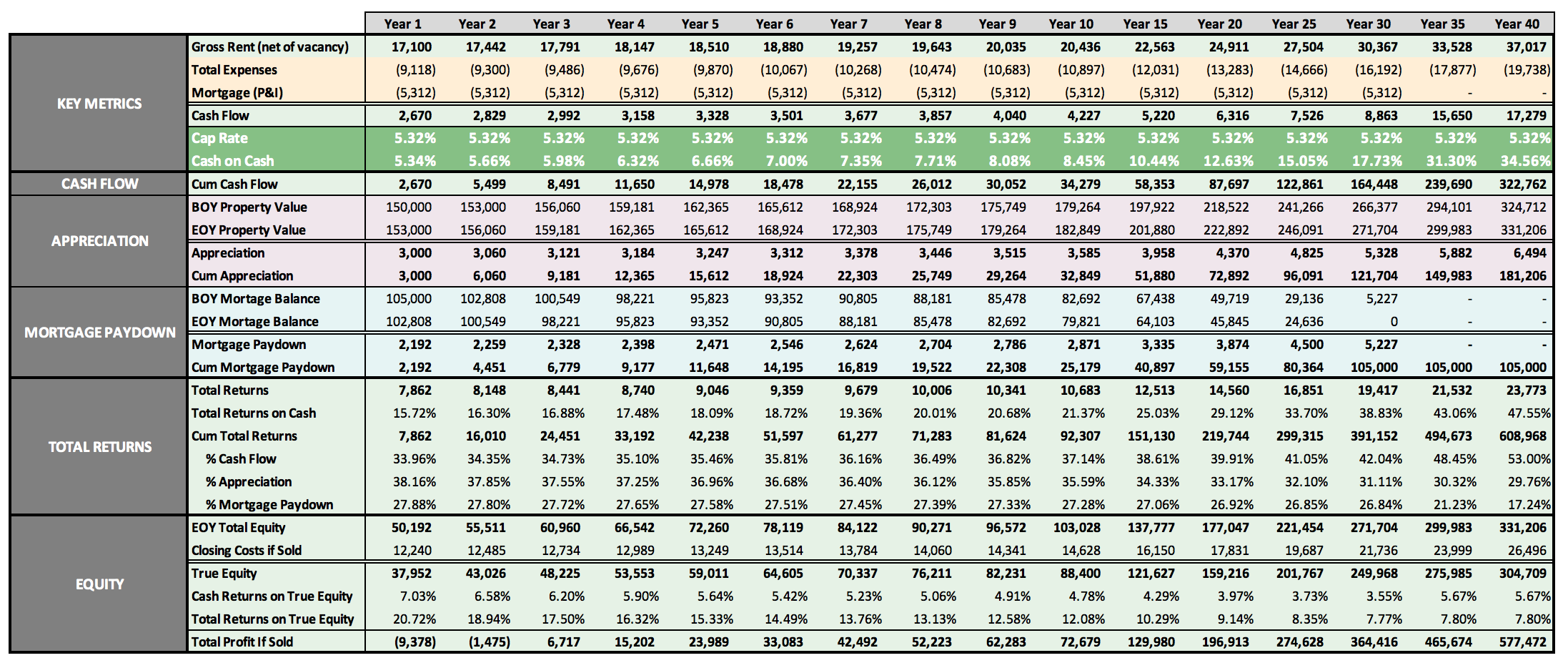

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

OR

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.