Monthly Portfolio Report: May 2022

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for May 2022. You can also check out all my previous monthly reports.

Property Overview

Maintained full occupancy again this month. This is good news, of course, but let’s temper that with a few reality checks (as I mentioned last month):

Two tenants have vacated, so I’m in the midst of two simultaneous turns. One of them is a little pricey, and one of them is a real WHOPPER of a turn. I’ll provide more details on that in June’s report next month, when those costs are booked.

Nothing has changed with the eviction at Property #9 — still no court date. Will I ever get possession of this house again? I’m starting to wonder. But there was a bit of a silver lining in May: I received nearly 3 months of back-rent on this property courtesy of a local rent assistance program. This doesn’t affect the eviction process, since the tenant is still ~5 months behind — but does this mean the tenant will be able to climb out of the hole? I have no idea, but my PM is attempting to help them connect to other sources of rent assistance. We’ll see…but I’m happy to get the payment, whatever happens next.

Rents

As mentioned, I received nearly three months of back-rent on Property #9, which juiced my collections this month and offset the monthly shortages I’ve been facing since that tenant stopped paying.

There were a few other interesting things to note this month. First, I charged and received no rent at Property #14, which is one of the two being turned at the moment. This was because the tenant pointed out that they had paid “last month’s rent” when they signed their lease many years ago. I failed to notice this when I bought the property — it was in the ledger, but not in the lease — and therefore I didn’t collect that amount from the seller at closing. Oops! I wouldn’t make that rookie mistake today, but I had to take my medicine to the tune of ~$1200. (If only I’d had a coach when I was starting out…)

Also, I had rent increases take effect at several properties this month. My PM is asking for larger rent increases where appropriate, to keep my properties close to market rent. (Faster rent increases is another reason why owning rentals in a high-inflation period is a boon.) Here are the increases that took effect this month:

Property #4: Raised from $931 to $1,075 on lease renewal (15% increase)

Property #6: Raised from $1,190 to $1,286 on lease renewal (8% increase)

Property #7: Raised from $795 to $830 (second year of a two-year lease — 4% increase)

Property #8: Raised from $1,196 to $1,291 on lease renewal (8% increase)

I’ll also have large increases in rent on both properties I’m turning once new tenants are placed. This is all good news for my long-term returns.

It’s not great news for the tenants, of course. And I feel for them — I’m a renter myself, and my landlord asked for a 31% increase in my rent at my last renewal! (I negotiated down to a 16% increase…but still.) Ultimately, though, my goal as a landlord is to provide a quality home that is safe and clean, professional service to deal with any issues that arise, and to do that at a fair price. (And, obviously, to make a profit doing it.) I’m still achieving that for these tenants — but when market rents increase as quickly as they have been, you have to expect your rent will increase in kind.

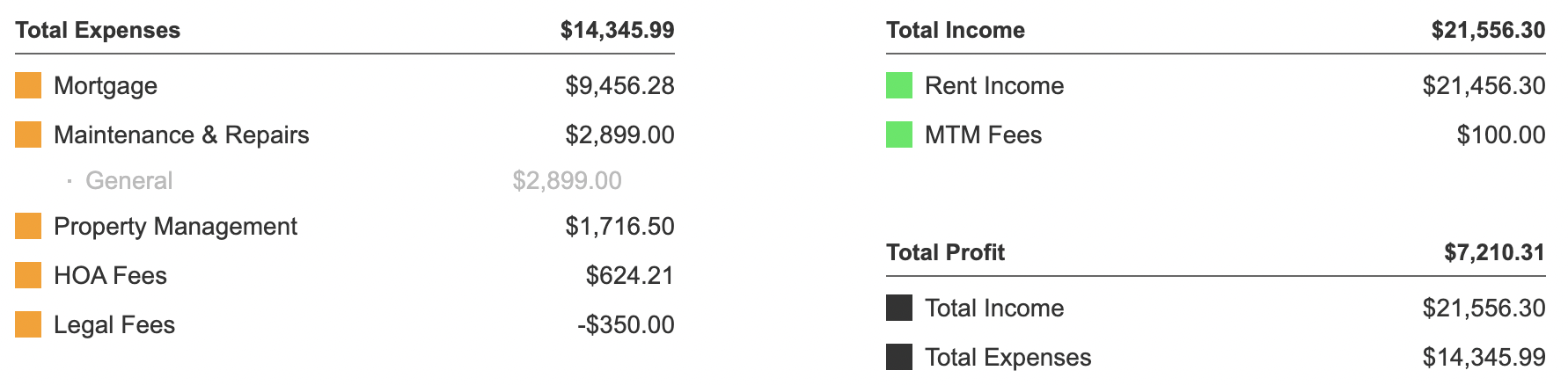

Expenses

Here are the highlights with my expenses this month:

Maintenance & Repairs: As I hinted at last month, I had a large expense this month (about $2K) because I had to re-do the tile surround of a tub. It was a nice tub/shower with a window, so I couldn’t do the typical solution which is a one-piece surround that fits over the existing tile. The new tile looks great, but it wasn’t cheap. The rest of this month’s costs were typical minor issues (i.e. plumbing, HVAC, carpentry, etc.)

HOA Fees: These normally don’t show up for my Memphis properties, since HOA’s are extremely rare in B and C neighborhoods. However, I do have one house (Property #8) with an HOA, and this covers two annual payments. (Somehow I missed last year’s invoice.)

Legal Fees: This refund came from the aforementioned back-payment of rent at Property #9, part of which was applied to the legal fee I paid to file the eviction.

The Bottom Line

My financial model currently projects my Memphis portfolio to generate $6,718 of positive cash flow in an average month. (This is several hundred dollars higher this month thanks to those rent increases I outlined above.) This month, the positive cash flow was $7,210, about $500 above target. This is due to my strong collections and that back-payment — otherwise, I would have missed the mark by a bit.

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. May was above the line, and I’m ahead of the pace so far for the year — but alas, that surplus will be more than exhausted by the turn costs I’m incurring in June. (Next month’s report will be a bloodbath, you won’t want to miss it! ;-)

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.