Monthly Portfolio Report: June 2020

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my clients and my readers. I also think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for June 2020.

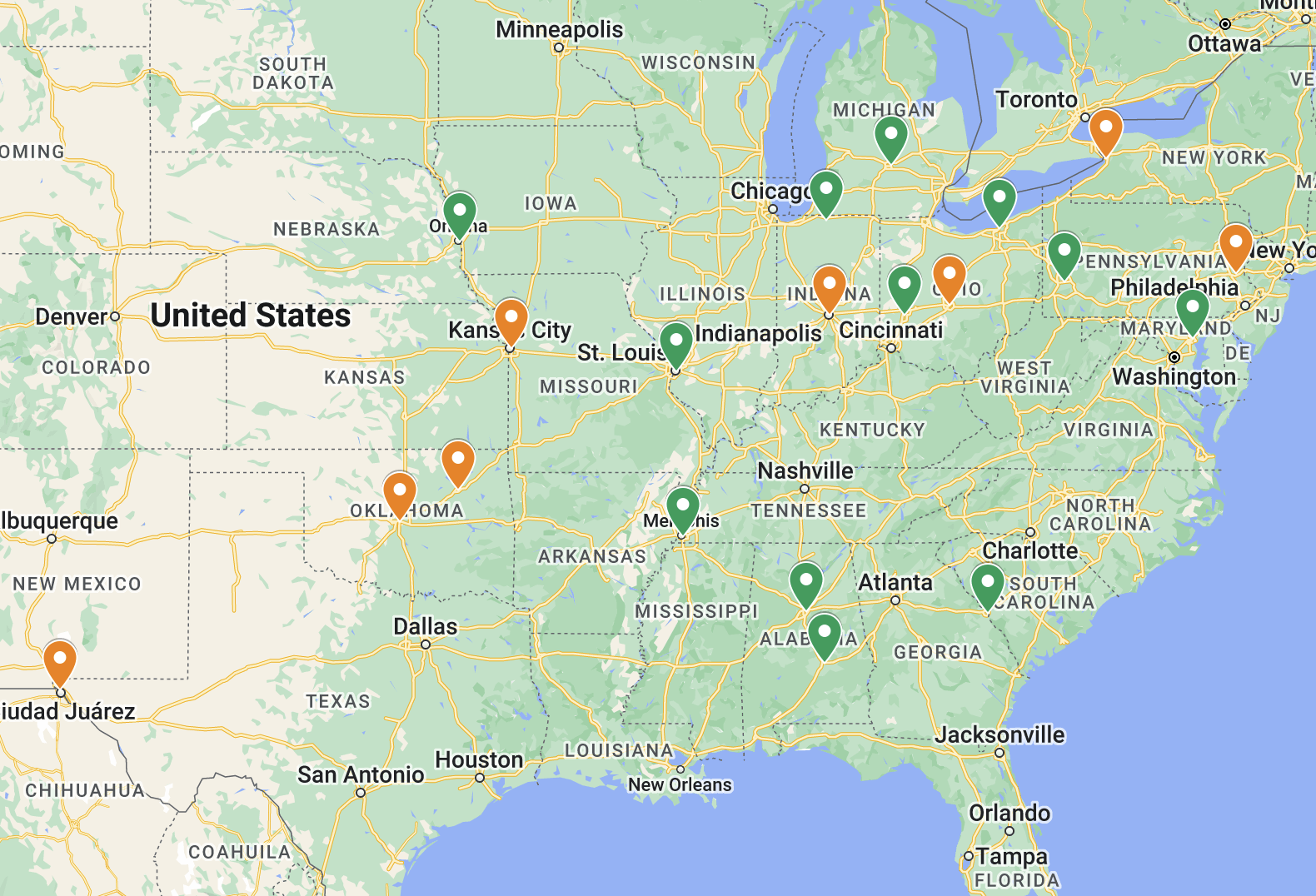

Property Overview

One of my tenants vacated as of June 1st, but the house was built in 2017 so there was very little work to do to get it rent-ready. This kept my turnover costs down (see below), but also allowed me to turn the property very rapidly. My property manager got a new tenant in place faster than expected, by June 19th, which is why I indicate a fractional month of occupancy for June.

As a bonus, the new tenant’s rent was $70 higher, and my property manager collected 2-month’s security deposit. The success of this tenant turn really illustrates the importance of a good property manager!

Rents

First, my monthly gross rent increased by $70 to $16,170, again due to the increase in rent at the property that turned over to a new tenant last month.

As for my 102.5% collections rate, one tenant was a bit short ($90) on June rent, but this was more than offset by:

An additional $241 of Section 8 rent that was mistakenly sent to my previous property manager earlier this year while I was transitioning my portfolio to my new property manager. It took a while to recover that money, but it eventually came through.

My property manager retained $235 of the previous tenant’s security deposit at the house that turned this month. There was some damage to the baseboards that exceeded normal wear & tear, and the tenant had not kept up with trimming the bushes in the front yard, which is their responsibility. (I track “retained security deposits” as a separate category of income, but it’s still income so we’ll lump it all together for these purposes.)

I continue to be concerned that the Covid-19 pandemic will negatively impact my tenants’ ability to pay rent, but so far that has not materialized.

Expenses

There were several unusual things with expenses this month that require some explanation:

Mortgage: careful observers will note that this is more than $400 lower than my regular amount. This is because of several escrow refund checks. On a yearly basis, banks will evaluate a loan’s escrow account to see if they are collecting the right amount each month in order to cover the property taxes and insurance they pay on the owner’s behalf. Many of my loans are hitting their 1-year anniversary, and the banks have determined in most cases that the escrow accounts have a surplus. When this happens, they send you a check for the amount of the surplus. Woohoo, free money! (Not really, of course. But it still feels like it!)

Property Management: This is higher than usual because I paid a Leasing Fee for the new tenant my property manager placed. This fee is 50% of a month’s rent.

Maintenance & Repairs: You can see the split between “General” expenses (typical stuff like a toilet repair, HVAC repair, and annual inspection fee) and “Rent Ready” expenses, which was the cost of the scope of work at the house that turned over. As I mentioned, this is much lower than average because it was a brand new house built in 2017; the cost of a typical turn can easily exceed $2,000.

Utilities: I am responsible for utility costs while a property is vacant, but the Memphis utility company charges a $200 deposit when I connect the account. Once a new tenant moves in and they confirm that my portion has been paid, they refund the deposit. So this negative amount is because of a utility charge at the vacant property, and the refund of a deposit on another property that turned earlier this year. Woohoo, free money! (Again…not really.)

The Bottom Line

My budget model projects my Memphis portfolio to generate $4,529 per month in positive cash flow, which would yield a 10.28% cash-on-cash return. In June, the positive cash flow was $5,514, almost $1,000 more than expected. This was a surprisingly good month considering I turned over a property; I was helped out by the fact that it got re-rented so quickly, as well as the mortgage escrow refunds and the additional rents.

Finally, here’s the running tally and graph I’ll keep updated each month. While I’ve had three good months in a row, there will undoubtedly be worse months (i.e. those where I have to pay taxes or insurance on the 3 properties I own outright, or if there are larger maintenance expenses.) But the picture looks very pretty for now!

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.