Monthly Portfolio Report: December 2021

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for December 2021. You can also check out all my previous monthly reports.

Property Overview

As I mentioned last month, I recently turned both Property #19 and Property #17, but was expecting to be back at full occupancy in December. Unfortunately, the tenant move-in at Property #19 was delayed by a sewer issue that needed to be resolved, and as a result they didn’t move in until the last week of December. So I was only at 95% occupied this month.

But I’ll be 100% occupied to start the year, and looking to keep it that way. Unfortunately, I still have an eviction in progress that is hurting my collections, and will result in a turn in the next few months. More on that in the next section…

Rents

The tenant at Property #9 has continued to be delinquent on their rent, and I’m still awaiting a court date so that the eviction process can move forward. It has already been more than three months without rent at this house, so I’m very much hoping the process can move forward soon — but courts are backlogged, or so my PM has told me.

In addition to this uncollected rent, a portion of Section 8 rent at Property #10 was also missing, due to paperwork and systems delays from the local housing authority who administers the Section 8 program in Memphis. But it’s no big deal — the missing amount, along with the full January payment, has already come in, so I’ll book an offsetting overage in next month’s report.

Expenses

Nothing earth-shattering in my expenses this month:

Property Management: This was a bit higher than a typical month because it included a leasing fee for placing the new tenant at Property #19.

Utilities: I had a bloated utility bill at Property #19 during the turn, because of that sewer issue I mentioned. The intake line was leaking, so the house was wasting a lot of water. This was corrected before the new tenant moved in. (It was a large capital expense to dig up and replace the line; I’ll cover this and all my 2021 capital expenses in my upcoming annual summary.)

The Bottom Line

My financial model currently projects my Memphis portfolio to generate $6,035 of positive cash flow in an average month. This month, the positive cash flow was $5,306, slightly below target. The biggest thing that hurt me here was collections, as discussed above.

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. You can see that my total cash flow for 2021 fell about $10K short of my projected amount, but I’m only ~$4K short of the expected total since April 2020, when I started these monthly updates.

I’ll go much deeper into my full-year 2021 numbers when I publish my annual performance report — look for that in the next 1-2 weeks. (Here were my 2020 numbers if you want a refresher before the upcoming sequel...)

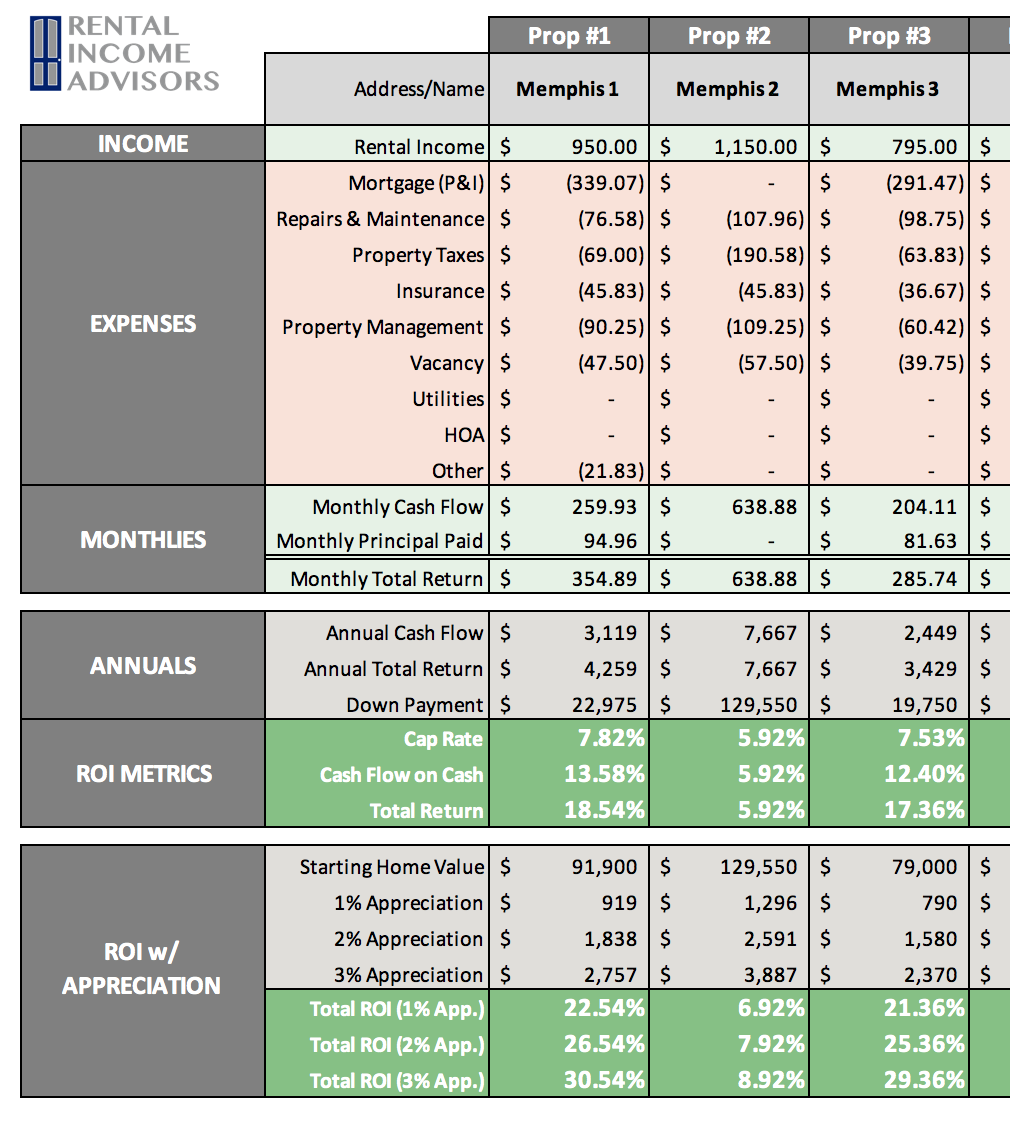

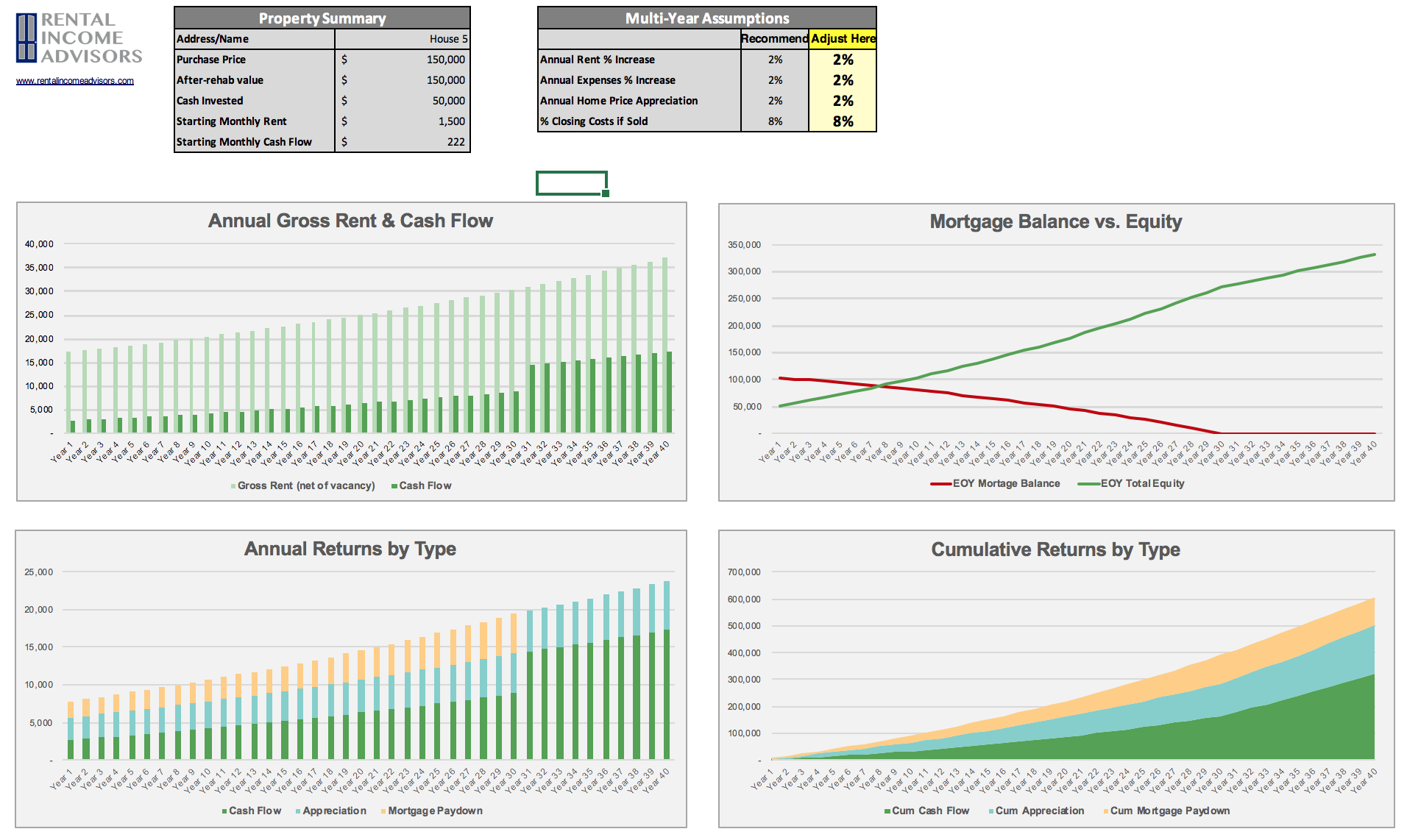

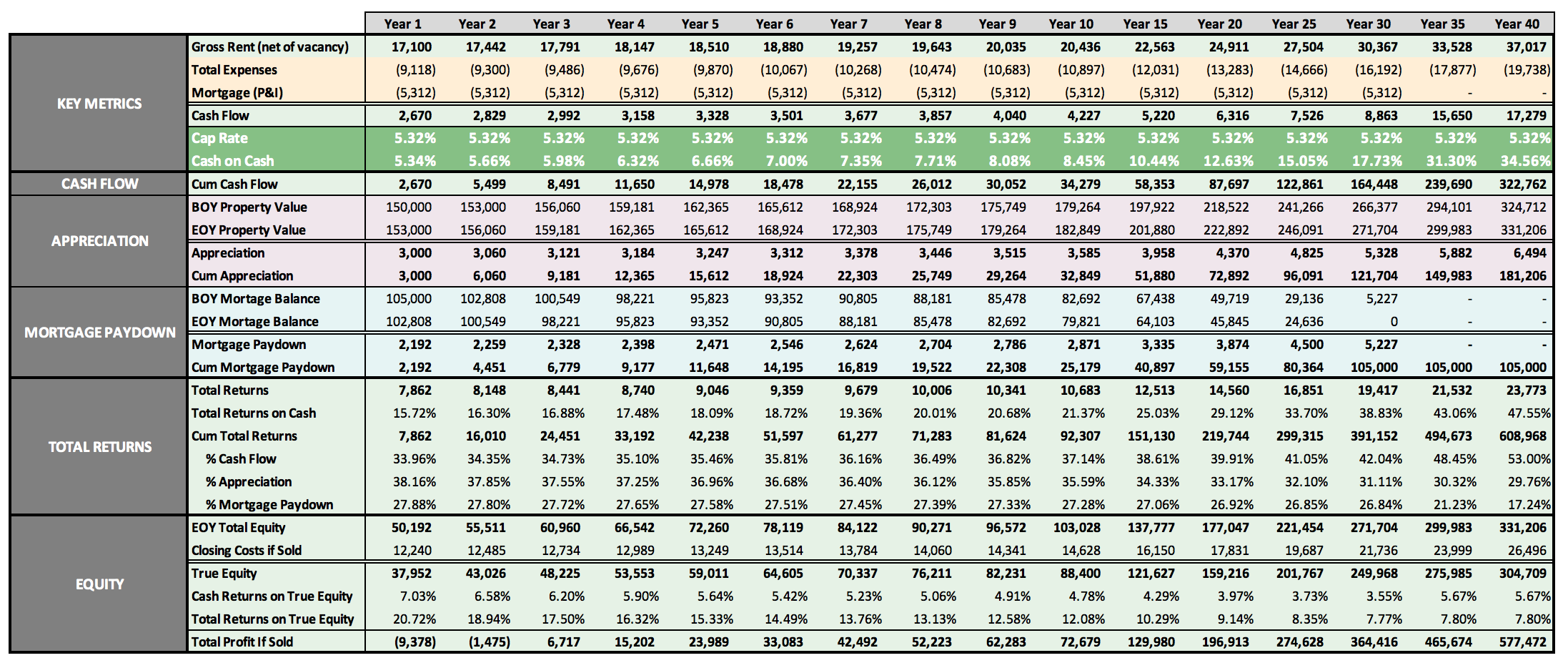

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.