How to Perform an Annual Checkup on Your Rental Properties — and My 2020 Checkup Results

NOTE: This article contains my 2020 portfolio numbers. My numbers for other years are published here.

When you see your doctor for an annual physical, the goal is to check your key numbers, evaluate your overall fitness, and identify any changes you need to make to improve your health in the future.

If you own rental properties, it’s a good idea to perform a similar kind of annual evaluation to monitor your investments, check their performance, and apply any learnings to your strategy going forward. In this article, I will describe the key metrics you should evaluate in your portfolio’s “Annual Checkup”, and what this process can teach you about how to be a better investor in the future. As we go, I’ll share my portfolio’s key indicators for 2020, and how I am applying those learnings this year and beyond.

(Yes, I know it’s nearly March. So I suppose this is like sending holiday cards in February. But it’s never too late to look at your full year numbers!)

Here’s a brief outline of the elements of the Annual Checkup that I’ll review in this post, split into two large sections:

A Financial Results

A1 Cash Flow vs. Projected Cash Flow

Review of Maintenance & Repair Costs

Rate of Rent Increase

A2 Change in Equity

True Appreciation

Mortgage Paydown

Capital Expenditures

Total Change in Equity

A3 Total Returns

B Tenancy Results

B1 Occupancy Rate

B2 Tenant Turns

Frequency

Duration

Cost

Finally, note that I will only include in this analysis those properties that I owned for the full calendar year — so it will include my first 16 properties in Memphis, but exclude properties I bought during 2020, including Memphis Property #17 and Memphis Property #18.

Alright, let’s get into it and see how healthy my portfolio was in 2020!

A Financial Results

Evaluating the annual financial performance of your properties is the first (and most important) part of the Annual Checkup. It will help you answer questions like these:

Did my cash flow meet expectations?

Were maintenance & repair costs in line?

Was I successful in raising rents?

How much did my total home equity increase (or decrease)?

What were my Total Returns on the cash I’ve invested?

The answers to these key questions will provide insights into your property manager, the state of the real estate market, and of course your properties themselves.

A1 Cash Flow vs. Expected Cash Flow

I’m first and foremost a cash flow investor. I want my properties to produce a lot of free cash, because this creates the freedom and flexibility in my life that I deeply craved back when I was stuck in my old W2 job. Cash returns are central to the allure of rental properties, and a significant part of the total expected returns for all but the most speculative rental investors. So it’s important to know whether your properties produced the cash they were supposed to, or whether they fell short.

Like most investors, I model my expected returns ahead of time, so that I know how much cash my properties SHOULD produce. This kind of model is frequently called a pro forma. For my modeling, I use the RIA Property Analyzer (and you can, too, because I make it available as a free download!) This tool quickly calculates an expected average monthly cash flow, after all expenses are accounted for; it also calculates an expected rate of cash-on-cash returns.

When I run the numbers for my portfolio in 2020, and compare them to the pro forma model, here’s what it looks like:

Overall, these properties generated $56K in cash flow, more than $4K better than expected, which translates into a cash-on-cash return of 9.4%, half a percentage point better than the 8.9% pro forma. While most individual properties met or exceeded their expected cash flow, there were a few that missed the mark. For the most part, this is due to variances in the maintenance & repair costs at each property, since most other costs are fixed and — as we’ll see later — I experienced very little vacancy last year.

But there are two properties in particular that are a concern. First is Property #8, which was the only property to LOSE money in 2020 — it was pretty much a bloodbath, in fact, costing me over $3,800 in cash for the year. This was due to an extended and painful eviction/bankruptcy that started in late 2019, and didn’t wrap up until last April when I was finally able to get the property re-rented. Not only did I have three months of vacancy, my rent-ready rehab was relatively expensive, at nearly $4K. Even in a good year, though, this is not a strong cash flow property, with a paltry pro forma cash-on-cash of 2.3%. I’m still hoping to be able to significantly raise the rent in the coming years — which is certainly possible given that this is the nicest property in my portfolio. But if not, I may have to sell this sooner rather than later so that I can re-invest the equity into more productive properties.

Property #13 also disappointed this year. I referenced the broken lease situation at this house in my December Monthly Update: the tenant vacated suddenly at the beginning of December, and left the house quite a mess. It cost me $3,500 to get it ready for the next tenant, nearly wiping out what otherwise would have been strong cash flow for the year. The good news is that the new tenant is paying $200/month more than the old tenant, so the financial picture of this property looks much stronger going forward.

Review of Maintenance Costs

The biggest variable component of a rental portfolio’s expense structure is maintenance & repair costs. Across all 16 properties, my model budgeted for $16,200 in maintenance & repairs. The actual number came in a bit higher, at nearly $19K — and as we’ve already seen, it was expensive turns at two properties that was a big driver of those costs:

For now, I’m still confident that my expense model is sound — I’d need to see a few more years of above-budget expenses before being convinced that I need to change my assumptions.

I also peeked at these maintenance numbers by property, and naturally there is some variation — but no occupied property was significantly above its budgeted repairs. If I did see that pattern, it might indicate a house whose condition means a higher cost of ownership than I first thought. But so far, no property sticks out as a “problem house”.

Rate of Rent Increase

It’s also useful to look at how much you were able to increase rents in the course of the year. This is important to the long-term financial success of the properties — after all, it’s a sure bet that expenses like property taxes, insurance, and repairs will become more expensive over time, so rents need to increase as well in order to maintain long-term profitability.

In my portfolio, my property manager is responsible for leasing vacant properties, and renewing existing tenant leases. Therefore, the rate of rent increase is really a performance metric for them, measuring how well they’ve been able to increase revenues across my portfolio.

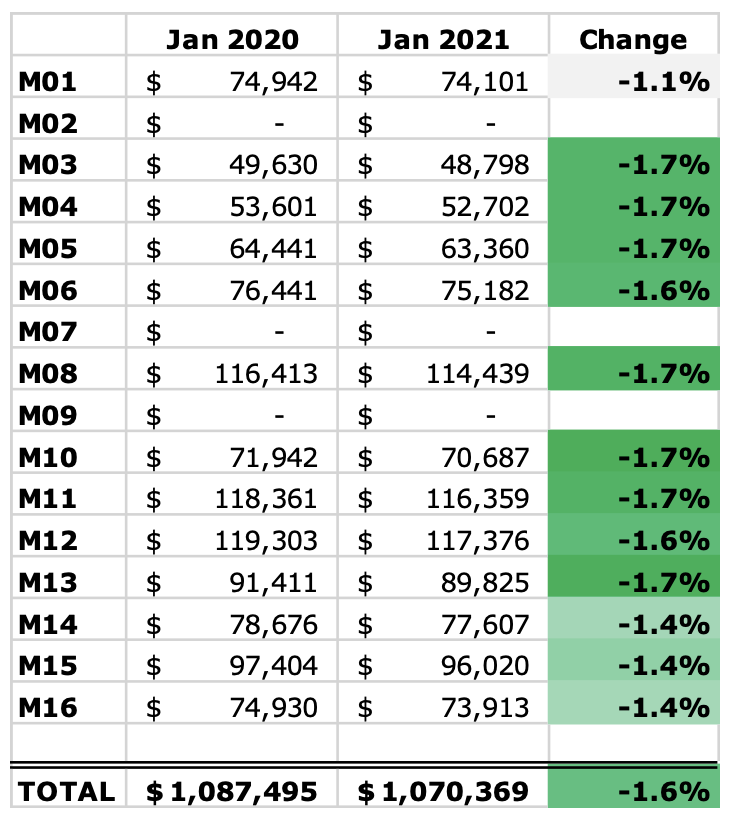

With inflation hovering around 2%, I’d want to see my rents increasing by at least this amount each year. Did I meet that target last year? Here’s a look at where my rents were in January 2021, as compared to January 2020:

Overall, rents across these properties increased at 3.4%, which exceeds the 2% inflationary target. In most cases, my property manager attempts to raise the rent 4% at the time of renewal — this is evident by the numerous properties that show a 4% increase. Some properties did not increase at all, either due to a multi-year lease or the tenant’s successful negotiation to keep the rent the same.

Property #13 is the one where I was able to raise the rent $200 after a tenant turn. But even taking out this large increase, overall rents still increased 2.2% across the portfolio, which is not great, but still exceeds the 2% target..

A2 Change in Equity

While cash is king in rental property investing, appreciation is still part of the equation. Particularly when using leverage, small increases in home prices can mean big returns — you capture all the appreciation, even if you’ve only put 20% or 25% down on the house. You also get the paydown of mortgage principal on those properties, yet another way to create positive returns.

On the flip side, capital expenses must be considered in this section as well. As I’ve argued before, capital expenditures are not true expenses, and are better understood as increases in the cost basis of the home; therefore, capex reduces your appreciation, not your cash flow. Here is where that reduction in appreciation will come into play.

Let’s look at each of these pieces that are part of the equity calculation — true appreciation, mortgage paydown, and capex — and see where those numbers landed in my portfolio last year.

True Appreciation

This one is pretty simple: how much did the value of each home increase in the last year? I track home values using the Zillow Zestimate, which has its flaws but it is nonetheless a straightforward way to see changes over time, and takes my own personal bias out of the equation.

This year, home prices experienced a pretty significant pop, particularly in the types of suburban neighborhoods where I invest. Countless articles have been written about the pandemic’s impact on real estate in 2020, but it boils down to this: big cities and dense areas suffered, while the suburbs and smaller markets boomed. That idea certainly held true in my portfolio — let’s compare my home values in January 2021 vs. January 2020:

Overall, my home values increased by about 13% last year, which is a huge single-year increase. A few houses popped even more than that, but the increases were broad-based and felt across all the neighborhoods where I own properties. There is a very evident “herding effect” of the Zestimate values here; again, algorithmic valuation tools are never perfect, but it’s still quite fair to say that prices went up a lot last year, adding $200K+ in value to my holdings.

This sets the stage for really eye-popping returns on cash invested, given that most of these properties are leveraged…

Mortgage Paydown

Home equity also increases each month on leveraged properties due to the loan principal slowly being paid off. This is the portion of rental property returns that is pretty much guaranteed — and as a bonus, it accelerates over the life of the loan.

Here’s a picture of the reduction in loan balances I experienced in 2020, which added another $17K to my annual returns (you’ll notice that three of the properties have no mortgages):

Not much more to say about this…but it sure is nice to see your loans melt away over time.

It’s interesting to see the variation in percent reduction of each loan, which is a function of the loan’s interest rate. My nonconforming loans on Properties 1, 14, 15, and 16 have higher interest rates than the conventional loans on the balance of properties, which is why their balances are shrinking more slowly in the early years of the loan. (Yet another reason why conventional mortgages are your precious “golden tickets”!)

Capital Expenditures

While I have MORE equity due to appreciation and mortgage paydown, I have LESS equity due to capital expenditures, which increase the cost basis of the property — in other words, they increase my cash invested into the house.

I did have a number of capital expenditures in 2020. Here’s a quick summary:

Property #3: $2,045 for a new HVAC condenser

Property #6: $1,125 for a new water heater

Property #10: $5,535 for a new roof

Property #13: $2,177 for some new flooring and a few replacement windows

So that’s a total of $10,882 in capex — but is that a lot, or a little? Investors use various methods to estimate and budget for capital expenditures. Some assume a percentage of the value of the properties each year, typically 1%. Others prefer to use a percentage of rent, usually 8% or 10%. Some prefer a fixed dollar amount per month per unit, such as $100.

I personally prefer the 1% percent of home value method. But using any method, my capex of ~$11K in 2020 seems to be well in line:

1% of home value: $1.65M x 1% = $16,500

8% of rent: $191K x 8% = $15,360

$100 per unit per month: 16 x 12 x $100 = $19,200

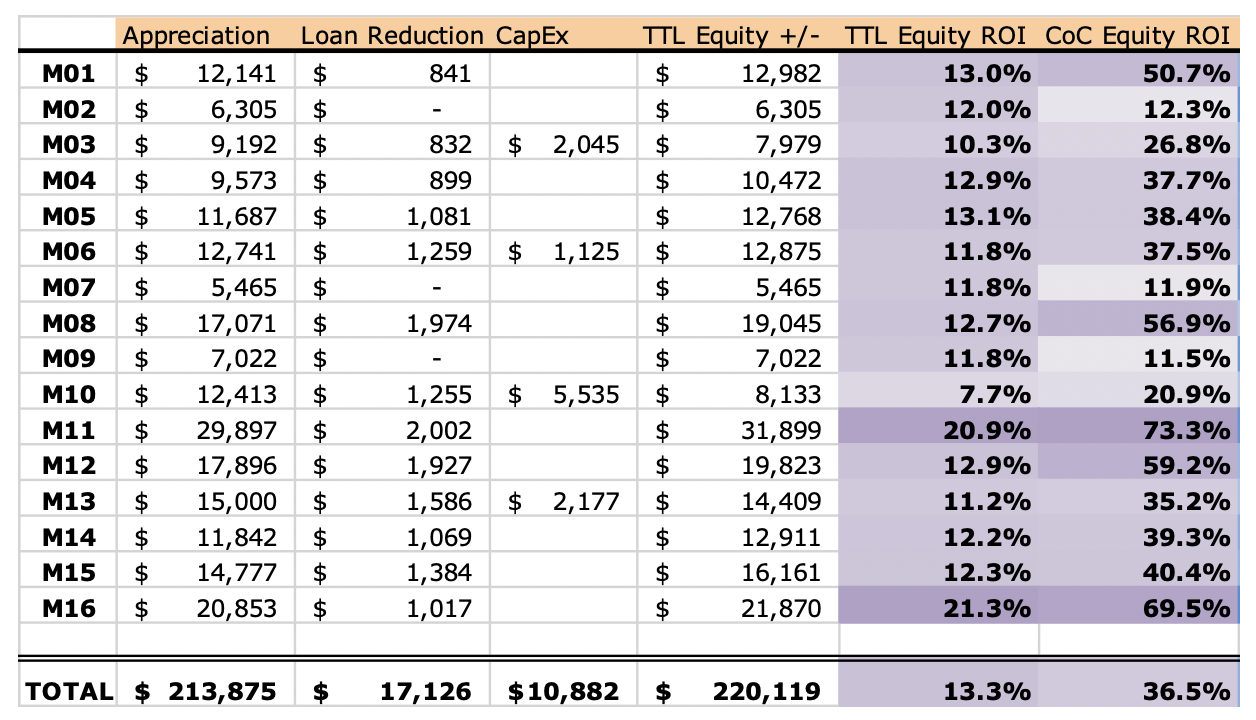

Total Change in Equity

Now let’s put all of these pieces together — appreciation, mortgage paydown, and capex — and calculate the total change in equity for the year:

Let me explain the two ROI numbers I calculated here:

TTL Equity ROI: Compares the total change in equity to the value of the property at the beginning of the year.

CoC Equity ROI: Compares the total change in equity to the total cash invested into the property.

Said a different way, my total equity across these 16 properties grew at a rate of 13.3% relative to their value at the start of the year, and at a rate of 36.5% relative to the amount of cash I have invested in the properties.

Obviously, these are outsize numbers that nobody should expect when they invest in rentals. It was a weird year all around, and real estate was no different. I fully expect more modest price growth in years to come — or perhaps even a pullback in prices at some point, particularly if/when interest rates begin to float higher.

A3 Total Returns

To calculate total returns, we’re simply going to add together the cash flow and equity portions that we’ve already calculated. Total returns is in important number — particularly your rate of total returns on cash invested — because that’s what you would mentally compare against other types of investments. For example, the stock market has historically returned ~10% total returns (before adjusting for inflation); if your rental properties are yielding total returns on cash of 10% or more, then you can assume that you’re beating the stock market. (Yes, I know that doesn’t include real estate transaction costs, taxes, and other factors — but my epic Stocks vs. Rental Properties article contemplates ALL those factors, if you want to dive deep into that perennial debate.)

Anyway, here’s what my Total Returns look like for 2020, putting together all the numbers that we’ve looked at so far:

Here’s how I calculated the three rate-of-return metrics above:

Total ROI: Compares Total Returns to the value of the property at the beginning of the year.

Total RoE (Return on Equity): Compares Total Returns to my total equity in the property at the end of the year.

Total RoC (Return on Cash): Compares Total Returns to the total cash invested into the property.

Or said a different way, my Total Returns across these 16 properties were equal to 16.7% of their value at the start of the year, 45.9% of the amount of cash I have invested in the properties, and 34.7% of my current equity in the properties.

It’s pretty hard to argue with those numbers! However, a lot of that was driven by a very high rate of price appreciation this year, which I don’t expect to repeat or continue; perhaps more important to me is that the portfolio met (in fact, slightly exceeded) the expected rate of CASH returns, which I DO expect to continue, and which provides the foundation for the financial and work freedom that I currently enjoy.

B Tenancy Results

The second large section of the Annual Checkup will be a close look at tenancy. While these factors influence the financial results that we’ve already reviewed, it’s important to break them out separately to understand them — just as variable costs of maintenance & repairs can make or break a property’s financial results, so can your ability to keep your properties occupied with quality tenants.

Or, actually — your property manager’s ability to do so. Because my PM is fully responsible for keeping my properties occupied with strong tenants, this entire section is largely a reflection of their degree of success with this critical task.

B1 Occupancy Rate

This key metric is simply a measure of the percent of the time that your properties are occupied. (Just as often, the inverse metric, Vacancy Rate, is used — but I like Occupancy Rate better, simply for psychological reasons. It just seems more positive, right?) In my expense modeling, I always use a 5% vacancy factor (assuming 95% occupancy), because I know that some percentage of the time I won’t be collecting rent on properties, such as when they are being turned between tenants.

So the question here will be: did my portfolio exceed the 95% occupancy threshold that I budgeted for?

Calculating vacancy rate is pretty simple. Each combination of a month and property (i.e. April at Property #3) is a slot to be potentially filled — this serves as the denominator of the fraction. The number of slots that were, in fact, occupied, is the numerator. For example, if you owned two properties for the full year, that’s 24 “tenant month” slots; if the first property had no vacancy, and the second property was vacant for 1 month, that’s 23 out of 24 tenant months that were actually occupied. So your occupancy rate would be 23 divided by 24, or 95.8%.

One quick caveat: I count a property as occupied if I’m collecting rent on it, whether or not a tenant is actually living there. For example, in a lease break situation where I retain a 1-month security deposit after the tenant moves out, I count the property as occupied for that additional month. Conversely, if a tenant IS in place but I’m never able to collect rent for that month, then I count the property as vacant. This aligns with my pro forma modeling, which does not budget for vacancy in the strict sense of the word, but instead for months where rent is not collected.

Using this math across my 2020 portfolio, here’s what I found:

In total, then, these 16 properties maintained over 98% occupancy in 2020. This is a great result that contributes to the fact that my cash flow results exceeded my modeled expectations.

Only two properties had any vacancy:

Three months at Property #8 due to eviction/bankruptcy

~20 days at Property #12 during a quick tenant turn

B2 Tenant Turns

Turning properties between tenants is a big driver of cost in any rental portfolio. It’s the dreaded “double whammy”: not only do you have to pay for the work to get the property ready for the next tenant, you’re also not collecting any rent during that period. (To add insult to injury, you also have to pay for utilities during the turn — so it’s nearly a triple whammy!)

Proper management of tenant turns can therefore be a critical way to ensure the success of rental property investments. There are three primary objectives when it comes to turns, and they’re all worth monitoring in your annual checkup. In a perfect world, you want turns to be:

Infrequent. By screening tenants properly upfront, providing them with a quality home, and responding professionally to any issues they’re having, your PM can make it more likely that tenants will stay longer, which decreases the number of turns you have to do in any given year.

Short. If turns must occur, you want them to be as short as possible. This is a measure of how efficiently your PM can complete the rent-ready work, and get a new tenant in place.

Inexpensive. If the home was maintained properly during the tenancy (by both the tenant and the PM), and if the property was up-to-standard beforehand, then turns should be relatively cheap; if not, they can get quite costly.

Let’s see how well I achieved those three turn objectives in 2020.

Frequency

How often should you expect to turn a property? The less the better, of course — but I want my tenants to stay at least 3 years, on average. This means that in any given year, I should expect to turn about a third of my properties. We’re examining 16 properties in 2020, so turning 5-6 properties would have been an average year by this standard.

Instead, I only turned 3 properties — #8, #12, and #13. Purely from the standpoint of turn frequency, then, 2020 was much better than expected.

Duration

Were those three turns performed efficiently? Let’s take a close look at them:

I think all three turns were a success from an efficiency standpoint. In general, I’d say that any turn completed in less than 30 days is a huge win, and anything under 60 days is good. Only when the turn stretches into its third month would I become concerned and disappointed.

It’s worth noting the various ways my PM contributed to the efficiency of these turns. First, they consistently provided a scope of work for approval within 5 days of having access to the property. Second, even the largest scope (at Property #13) was completed in less than a month — with the winter holidays intervening, no less. And third, the leasing team found qualified tenants quickly for all three properties, often signing leases before the maintenance work was even finished.

Cost

As we’ve already seen, I had two relatively expensive turns in 2020 — and I do expect that my initial turns (the first ones I perform after buying the properties) may be a little more expensive as I get them up to standard in certain areas. Therefore, costly turns may be a fact of life for me for several years to come, since I chose to buy many of my properties when they were occupied with tenants, and only a handful of my houses were full turnkey properties when I bought them.

I expect a typical turn to cost between $1,500 and $3,000 — any turn under $1,500 is cheap, and one that exceeds $3,000 is relatively expensive. Here’s a glance at the three turns I did in 2020, and their costs:

Conclusion

When you go to your doctor for a physical nowadays, you often get the results through an online dashboard that lays out your numbers, highlights areas where there may be issues, and suggests how you can improve.

So I put together the same kind of dashboard for the health of a rental portfolio, incorporating all the key areas and metrics we’ve reviewed in this article. Here’s what mine looks like for last year:

Here are my key takeaways from this annual checkup:

Overall, it was a great year. Rapid price appreciation fueled very high rates of return on my invested dollars. I don’t expect this to continue.

My cash flow model is sound. The portfolio is producing the cash that it’s supposed to, which gives me confidence to continue to acquire properties using the same assumptions that are built into the RIA Property Analyzer.

My property manager is getting the job done. From occupancy rate to rent increases to management of turns, my PM is producing strong results for me.

Maintenance expenses were a bit high, driven in particular by costly turns. This is something I need to continue to watch in the coming years, to see if this becomes a pattern or turns out to be an anomaly.

I hope this article has illustrated the value of an “Annual Checkup” for your rental properties, and provided a useful structure that you can adopt for your own portfolio. Happy investing!

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.