Monthly Portfolio Report: September 2021

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for September 2021. You can also check out all my previous monthly reports.

Property Overview

Maintained full occupancy this month, woohoo!

Unfortunately, I do have a turn underway in October (at Property #19), so like all things, full occupancy won’t last forever.

Rents

Fully collected this month, plus a little extra back-rent that was owed from one tenant.

I mentioned in last month’s update that I had several September payments still outstanding quite late in the month. Those did eventually come in, but after the 20th of the month. The same two tenants are very late again on October payments. While it’s quite common for some tenants to pay late every month, this is very late in the month for several months in a row. In this kind of situation, sometimes tenants are able to catch up, and sometimes they fall further and further behind. Fingers crossed that they are able to get back on track.

Expenses

Clearly, this was the best month for expenses that I could possibly hope for: no one-time expenses this month (such as property taxes, insurance, turns, etc.) and I actually had negative maintenance & repair expenses! That clearly requires some explanation:

Maintenance & Repairs: First of all, I had very few expenses this month — just ~$400 from a few miscellaneous issues. But then, this was (more than) offset by ~$1K in refunds issues by my property manager across three properties. The majority of that ($800) was from Property #7, which if you’re a close follower of the blog you will recall had a VERY expensive turn earlier this year due to some unreported water damage, then had bees in the wall, then had major HVAC issues. The refund was due to my PM’s mishandling of the HVAC situation. The other refunds were for smaller issues that I had been pestering my PM about for months (one dating back as far as March!) I was patient, persistent, and professional in requesting and receiving these refunds, and it took a lot of time and communication — but I eventually got them.

This shows how important it is to keep an eye on your PM’s activities, but also to maintain strong, constructive relationships with them. Was it worth it to spend that much time and energy to make $1K? Debatable. But in addition to the money, it also sets the right expectations going forward, that I will hold them accountable to smart, competent management of my properties - so it may pay future dividends as well.

Of course, it also doesn’t hurt to have 20 properties. The larger your portfolio, the more concerned your PM will be if you’re unhappy.

The Bottom Line

My financial model currently projects my Memphis portfolio to generate $6,035 of positive cash flow in an average month. In September, the positive cash flow was $9,558, way above target.

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. New this month: I’ve added the actual values to the right, including totals for 2021 year-to-date, and since my first monthly update in April 2020.

With this strong month, I’m almost back to level with my YTD expectations…but that’s likely to fall back further in October, when I will pay for a surprisingly expensive turn at Property #19. More on that in next month’s update…

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

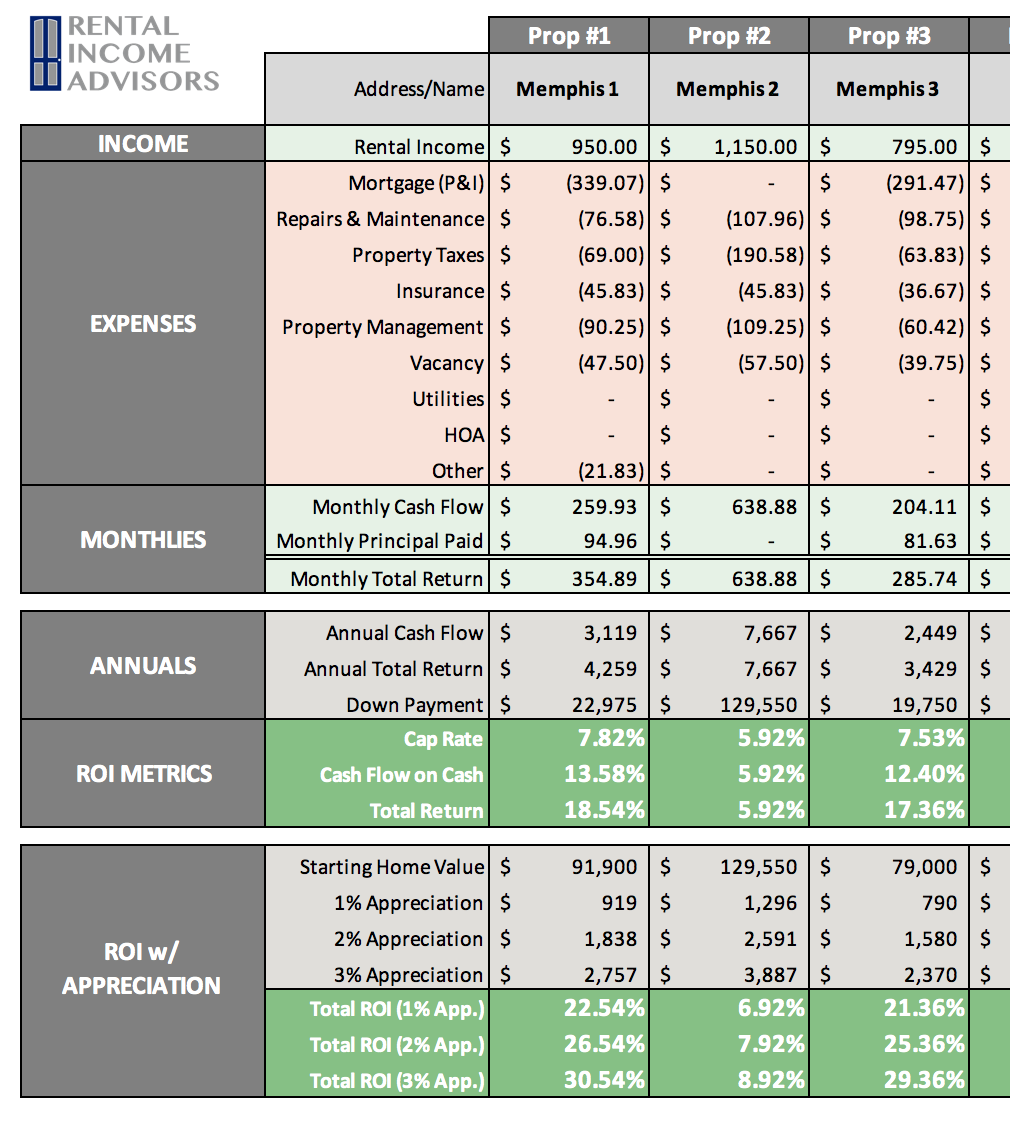

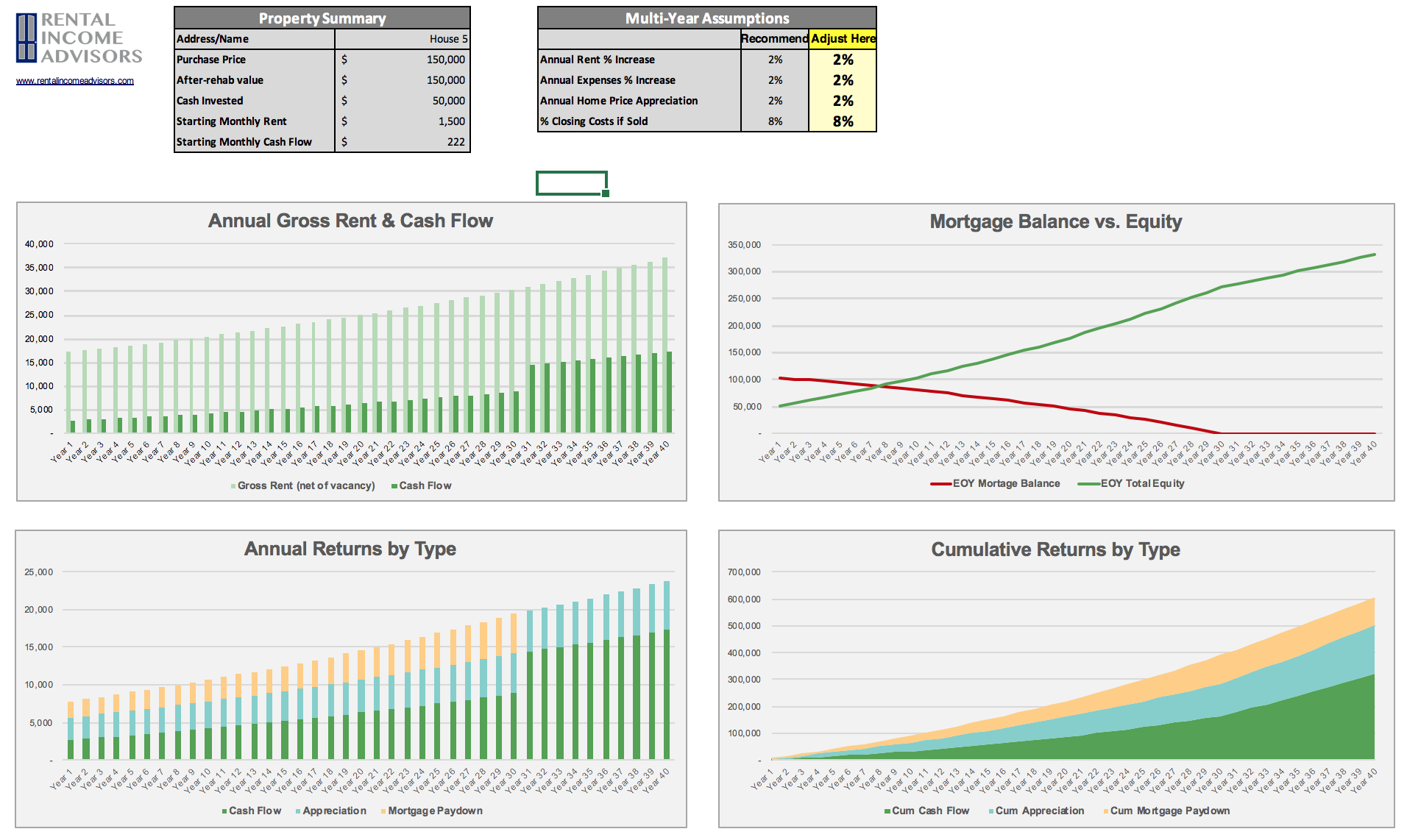

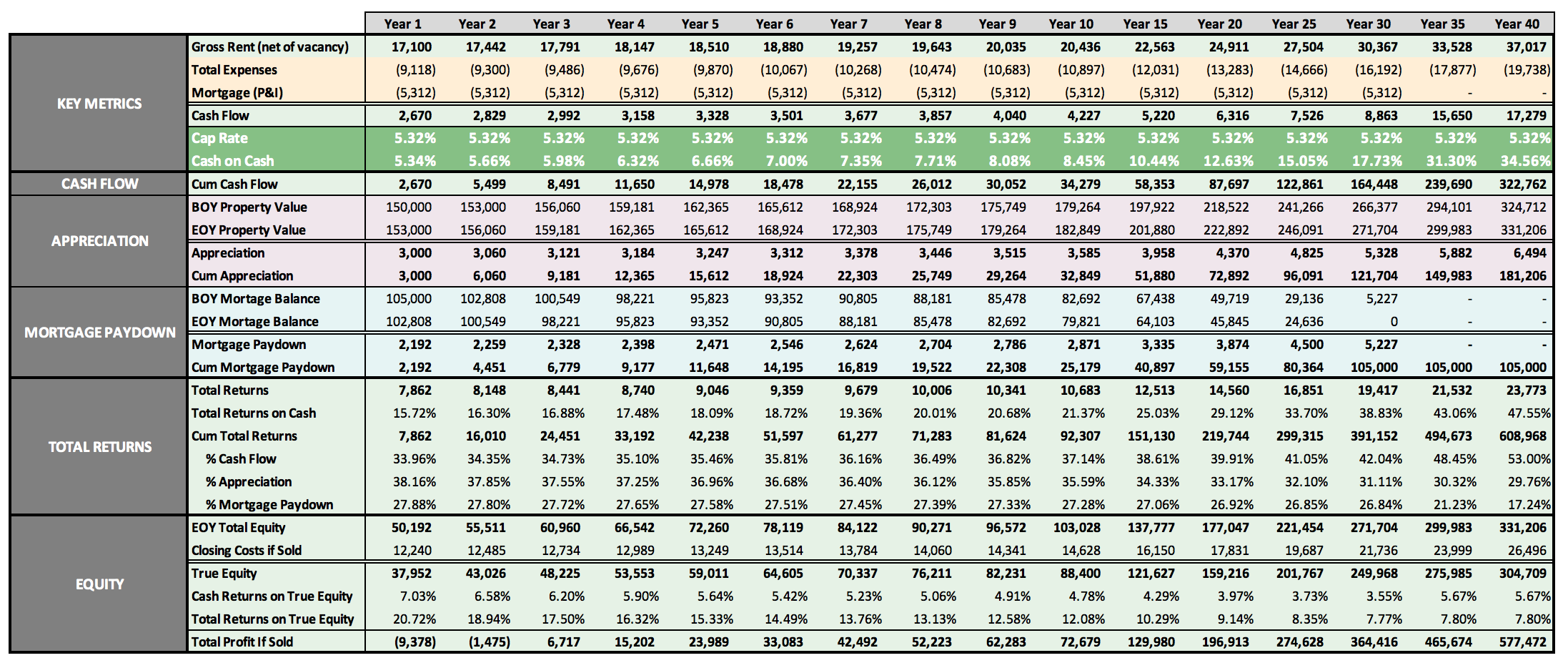

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.