Monthly Portfolio Report: August 2021

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for August 2021. You can also check out all my previous monthly reports.

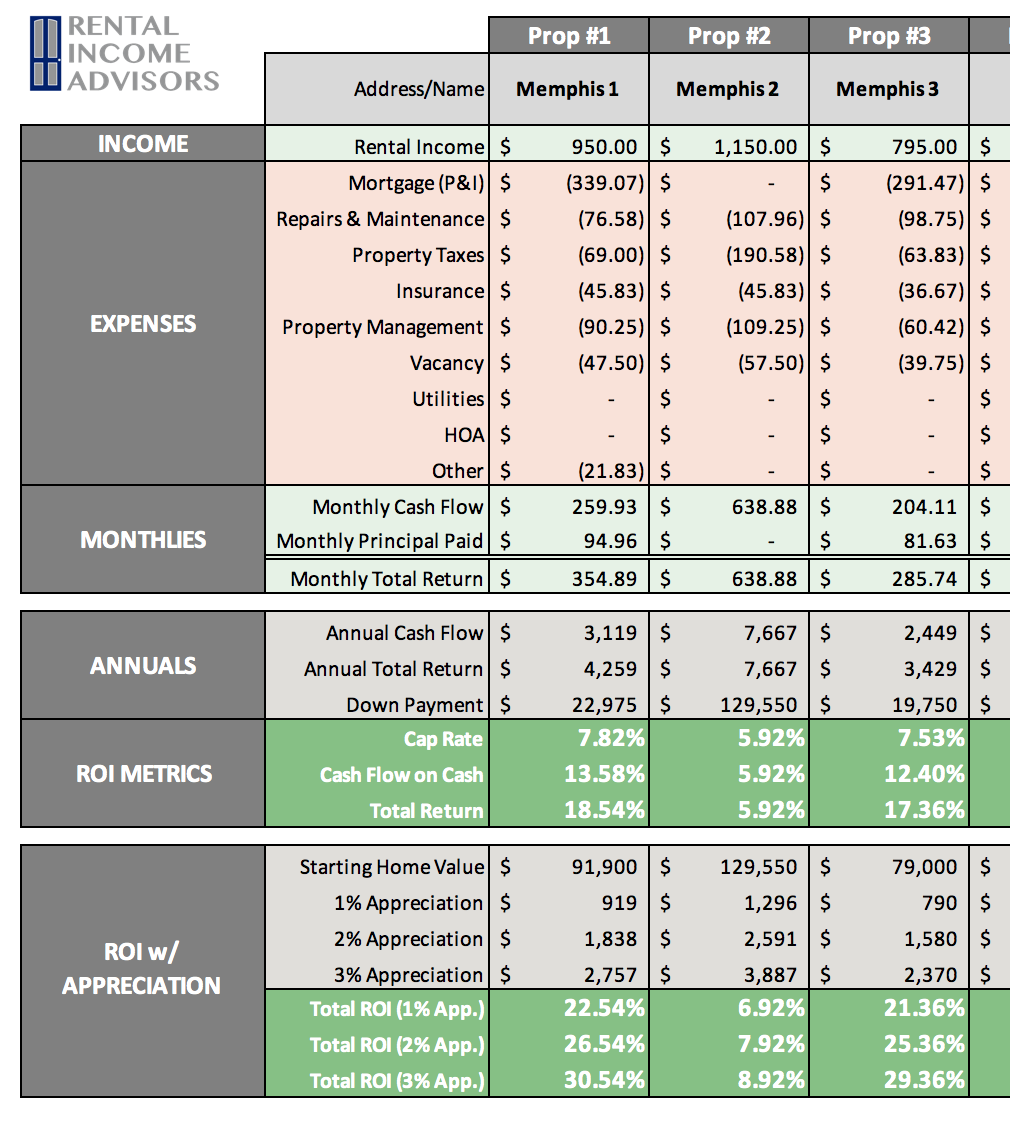

Property Overview

As I mentioned in last month’s update, the turn at Property #2 was completed, and a new tenant was placed in August, so I’m back to full occupancy!

The new tenant is also paying $130/month more than the previous tenant. Rents are definitely rising fast in Memphis over the last year — and in many other places as well.

Rents

No issues with collections this month — just a few dollars short from one tenant, I think because they failed to make up the difference from a tenant chargeback.

I still have several outstanding September rent payments, but they’re from tenants who habitually pay late, so I’m hopeful they’ll make their payments in the next week. (I’ll let you know in next month’s update if not — fingers crossed!)

Expenses

A few things require explanation this month:

Maintenance & Repairs: It was a pretty typical month of regular maintenance (annual inspections and HVAC issues, mostly). I also had a few final charges from my turn at Property $2, which was the $285 of rent-ready work.

Utilities: This is also from the turn/vacancy at Property #2, but it includes a connection charge that will be refunded when the tenant moves the utilities account into their own name. (In fact, the Utilities amount this month was offset by a refund of a connection charge from Property #7, a turn I did earlier this year.)

Property Taxes: I own three properties without a mortgage, which means I pay their bills (for property taxes and insurance) directly. This month, I paid the 2021 Memphis city taxes for those three properties.

Tenant Chargebacks: When a tenant is deemed responsible for a charge under the terms of their lease, I initially pay for it, but I get reimbursed when the tenant pays my PM. That’s what happened this month on a $150 chargeback, which is why I show a credit (negative expense).

The Bottom Line

My financial model currently projects my Memphis portfolio to generate $6,035 of positive cash flow in an average month. In August, the positive cash flow was $5,965, pretty much right on target.

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. Definitely some ups and downs this year, but that’s to be expected. I’m still a bit short of where I should be cumulatively for 2021, so hopefully I can make that up in the remaining four months.

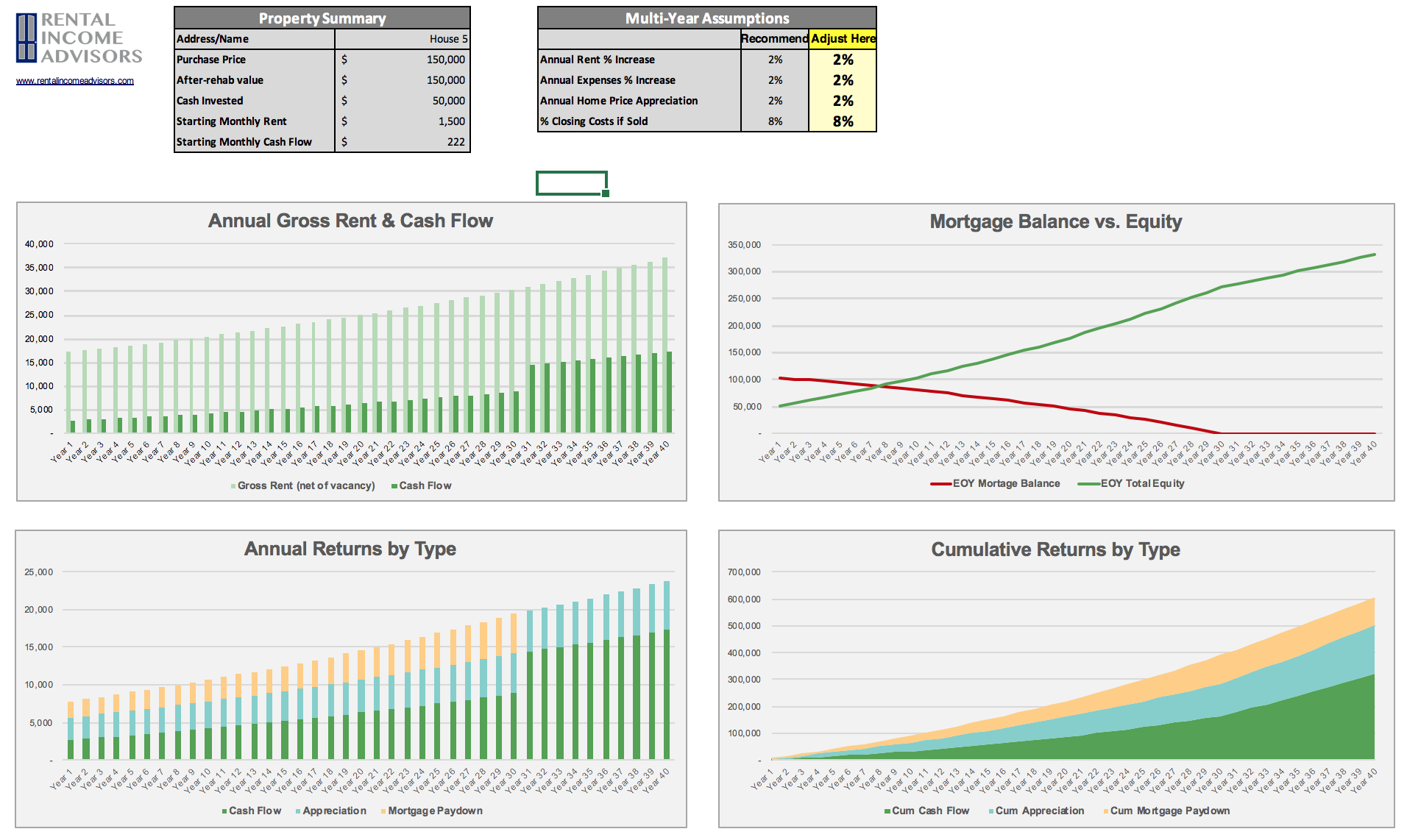

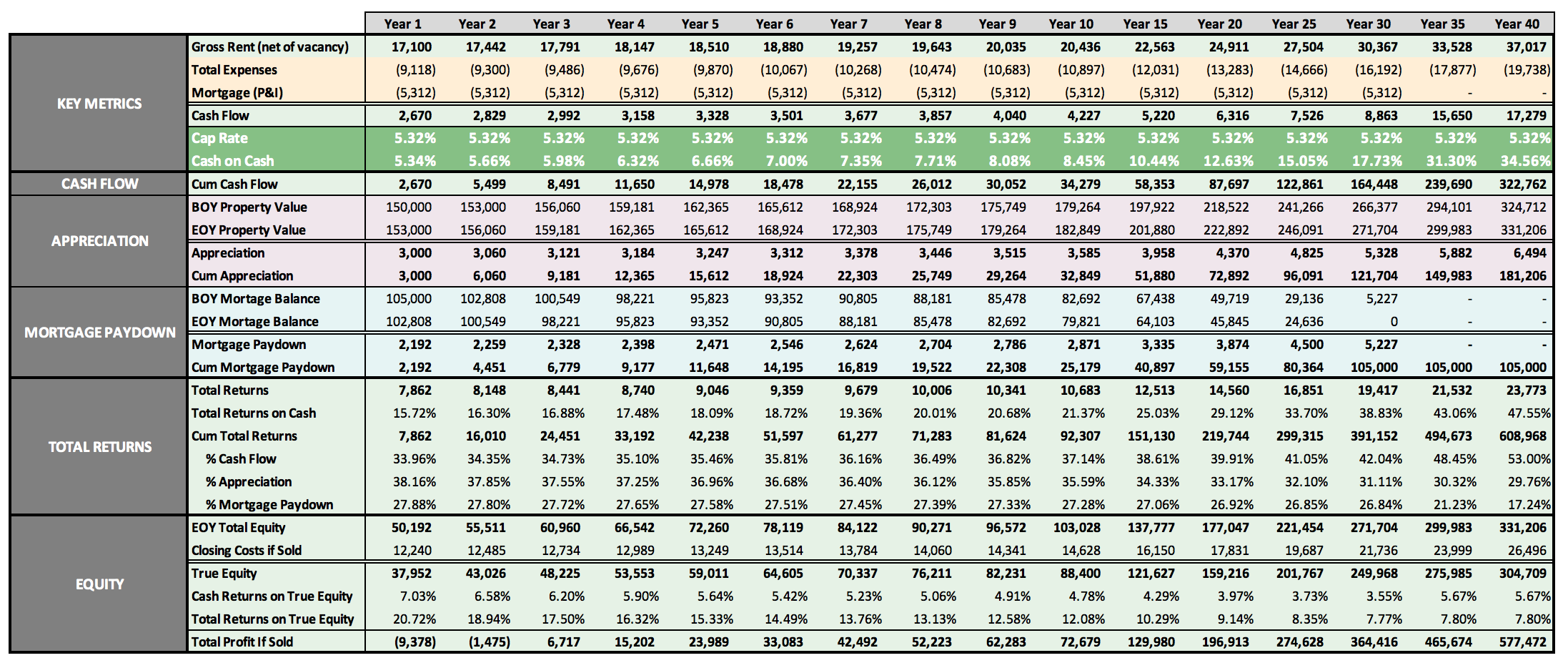

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.